The Canadian Dollar elected Monthly Bullish Reversals at the close of April suggesting that we can now see a rally up to the 82-83 level. Keep in mind that last year’s high was 86.03. Therefore, there is plenty of room for a continued reaction as the markets push everything to the limit.

In the Euro cash, we also elected a Monthly Bullish at the 114 level producing the highest closing so far on a monthly basis. Now we may at last see that rally up to the 116 level.

The Global Market Watch picked the low rather nicely and has been is a bullish mode now for the past three months.

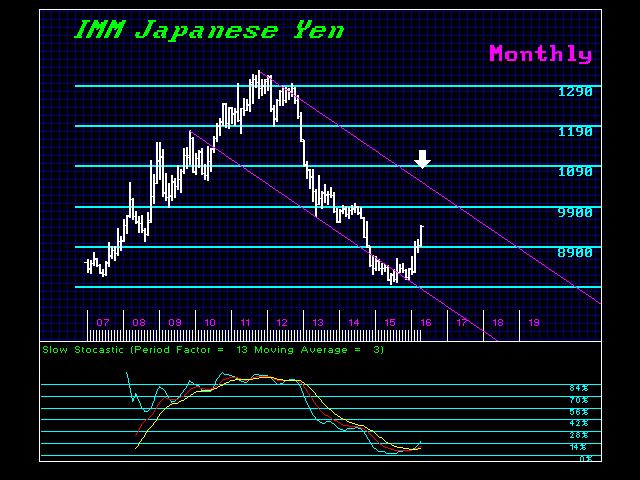

In the Japanese yen, we did not elect any Monthly Bullish Reversals at the end of April. However, we did elect TWO Monthly Bullish back in February. This implies we should see a bounce but resistance will stand at the 92 level.

Overall, this is the purpose of creating a quantitative model that function without human emotion – very plain and to the point. May has been showing as the month on our timing models in currencies this year. So as we now enter May, be on point. Just play this by the numbers and do not get emotionally attached to a trade. As we make the reaction high, the talk should be bearish on the dollar and that will help trap people into buying that new high.

https://www.armstrongeconomics.com/markets-by-sector/foreign-exchange/month-end-closing/

» utube 11/13/24 MM&C MM&C News-Private Sector- Electronic Payments-Reconstruction-Development-Digit

» utube MM&C 11/15/24 Update-Budget-Non Oil Resources-CBI-USFED-Cross Border Transfers-Oil

» Al-Sudani is besieged by lawsuits over the “wiretapping network”... and Al-Maliki heard “inappropria

» Tens of thousands of foreigners work illegally in Basra... and the departments will bear the respons

» 4 reasons for the Sudanese government’s silence in the face of the factions’ attacks.. Will Baghdad

» PM's advisor: Government able to increase spending without inflation or fiscal deficit

» Prime Minister stresses the need to complete 2024 projects before the end

» Minister of Labor sets date for launching second batch of social protection beneficiaries in the pol

» Al-Sudani approves 35 new service projects, stresses the need to complete 2024 projects

» Minister of Labor: The population census will provide accurate calculations of poor families covered

» Electricity announces its readiness for the winter peak

» Economist: Parallel market remains pivotal to financing Iraq’s trade with Iran, Syria

» Trump: Iraq: A subsidiary or the focus of major deals?

» Counselor Mazhar Saleh: The government is able to increase spending without causing inflation or a f

» Al-Sudani's advisor to "Al-Maalouma": We do not need to bring in foreign workers

» Parliamentary Rejection.. Parliamentarian Talks About Jordanian Agreement That Harms Iraq’s Economy

» Al-Sudani chairs the periodic meeting of the service and engineering effort team

» Al-Sahaf: Washington continues to support terrorist organizations in Iraq

» Al-Maliki Coalition: America is trying to make Iraq hostile to its neighbors by violating its airspa

» Close source: Al-Sudani failed to convince Al-Hakim and Al-Amiri to carry out the ministerial reshuf

» Al-Sayhoud on Postponing Parliament Sessions: Bad Start for Al-Mashhadani

» Peshmerga Minister: The survival of the Kurdistan Region depends on the presence of a strong Peshmer

» Al-Maliki Coalition: US pressures prevent Israel from striking Iraq

» Nechirvan Barzani calls for keeping Peshmerga out of partisan conflicts, urges formation of 'strong

» US Institute: Trump administration may prevent Iraq from importing Iranian gas as part of pressure o

» The meter will visit families again.. Planning details the steps for conducting the population censu

» Government clarification: Is Iraq able to increase spending?

» Iraq advances over China.. Iran's trade exchange witnesses growth during October

» Al-Sudani approves 35 new service projects and begins implementing them within 10 days

» Al-Sudani and Al-Hakim discuss developments in the political scene and the results of the visit to K

» Minister of Labor: Government measures contributed to reducing the poverty rate from 22% to 16.5%

» Al-Maliki calls for strengthening national dialogue and unity to overcome the current stage

» Al-Sudani stresses the importance of accuracy and specifications in service and engineering projects

» Baghdad Governor: 169 projects are listed for referral and contracting

» Industry confirms success by signing 4 investment contracts for strategic industries

» Parliament confirms its support for conducting the general population census and decides to resume s

» Parliament gains a "holiday and a half"... Half of the "extended" legislative term passes without se

» Find out the exchange rates of the dollar against the dinar in the Iraqi stock exchanges

» Al-Maliki describes tribes as a "pillar" for confronting challenges in Iraq

» The plan in the "distribution method".. A representative describes the "investment achievement" as n

» Iraq is ahead of China in trade exchange with Iran.. These are the numbers

» MM&C 11/14/24 Central Bank Governor Urges Türkiye to Open Accounts for Iraqi Banks

» MM&C 11/14/24 Trump and the Iraqi Banks Puzzle

» New decline in gold in Iraq.. and globally records the worst week in 3 years

» Monitoring body approves 2023 imports annual report

» Development Road: Faw Port Ignites Regional Corridor Race

» First in Iraq... Diyala sets a plan for "rural reconstruction"

» Al-Saadi: Influential parties are working to erase the theft of the century file

» MP: Baghdad supports the "Diyala Artery" project with 40 billion dinars

» Source: General amnesty law will pave the way for the return of terrorist groups

» The Prime Minister stresses the need to expedite the completion of the requirements for restructurin

» Minister of Resources: The project to develop the left side of the Tigris River has reached its fina

» Foreign Minister: We are proceeding with implementing the associated gas exploitation program

» Swiss Ambassador Expresses His Country's Desire to Invest in Iraq

» "We left the camel and its load" .. Moroccan farmers await "imminent compensation" from Iraq

» OPEC sues Iraqi minister over oil violations.. What is Kurdistan's involvement?

» Iraq warns of 'dire consequences' of imposing barriers to plastic products

» Iranian newspaper: Iraq's development path is a step towards regional economic integration

» Al-Mandlawi discusses with the Russian ambassador developing relations in the fields of economy, inv

» Oil Minister discusses with Dutch Ambassador strengthening bilateral relations

» The Minister of Oil discusses with the companies "+dss" and "Xergy", joint cooperation to develop th

» Rafidain Bank announces a plan to include other branches in the implementation of the comprehensive

» With the presence of the opposition... Baghdad supports the partnership government in Kurdistan

» Parliamentary move to raise retirement age in state institutions to 63 years

» Through leaks.. Warnings against creating political crises as parliamentary elections approach

» Iraqi oil returns to decline in global markets

» Parliamentary Committee: Iraq uses its international relations to avert the dangers of war from its

» The value of non-oil imports for Sulaymaniyah and Halabja governorates during a week

» Rafidain: Continuous expansion in implementing the comprehensive banking system

» Planning: The population census includes residents of Iraq according to a special mechanism

» Transparency website reveals non-oil imports to Sulaymaniyah and Halabja during a week

» Al-Sudani directs the adoption of specialized international companies to prepare a unified structure

» MP warns of a move that will worsen the housing crisis and calls on the government

» Disagreements strike the Kurdish house... hindering the formation of the regional parliament and gov

» Hundreds of Moroccan farmers are waiting for “imminent compensation” from Iraq.. What’s the story?

» Iraq 10-Year Review: Spending, Imports, Unemployment in 2024 at ‘Highest Level’ in a Decade

» Call to all smokers in Iraq: Prepare for the law

» utube 11/11/24 MM&C News Reporting-IRAQ-USA-Financial Inclusion up 48%-Money Inside & Out of Iraq

» Al-Mandlawi to the UN envoy: The supreme authority diagnosed the problems and provided solutions for

» Saleh: Government strategy to boost gold reserves as part of asset diversification

» Prime Minister's advisor rules out oil price collapse: Trump's policy will not sacrifice petrodollar

» Tripartite alliance between Iraq, Egypt and Jordan to boost maritime trade

» Parliamentary Committee reveals date of entry into force of Personal Status Law

» Al-Fatah warns against US blackmail and Trump's intentions for the next stage

» A leader in the law: If the Americans do not leave on their own two feet, we will expel them in fune

» MP: Next Sunday's session will witness the passing of "important laws"

» There is a financial aspect.. Al-Zaidi rules out voting on the real estate law

» "Promising" economic opportunities in central Iraq open doors to investment, trade and unemployment

» Minister of Transport: Arab interest in the development road project

» Bitcoin Fails to Maintain Its Meteoric Rise

» Amending the retirement age on the parliament's table.. This is the latest that has been reached

» Launching the Health Unit Initiative in Iraqi Schools

» Will Iraq be the savior of the countries of the region if oil prices fall?

» Regarding electrical energy.. Government moves to meet the needs of next summer

» {Retirement age} sparks debate in parliament

» Minister of Transport to {Sabah}: Arab interest in the development road project

» Planning: Two important pre-census activities start today and tomorrow

» Next week.. contracting with 2500 applicants on a {contract} basis