China’s Market News: China Expands CFETS Yuan Basket, Cuts Dollar’s Weight

Thursday, Dec 29, 2016 10:59 am -08:00

by Renee Mu, Currency Analyst

This daily digest focuses on Yuan rates, major Chinese economic data, market sentiment, new developments in China’s foreign exchange policies, changes in financial market regulations, as well as market news typically available only in Chinese-language sources.

- U.S. Dollar, Euro, Yen, and Pound’s weights in CFETS Yuan Index have been reduced.

- China’s liquidity mechanism shows a clogging issue: non-bank institutions unable to borrow from banks.

- If you’re looking for more trading ideas, check out our Trading Guides.

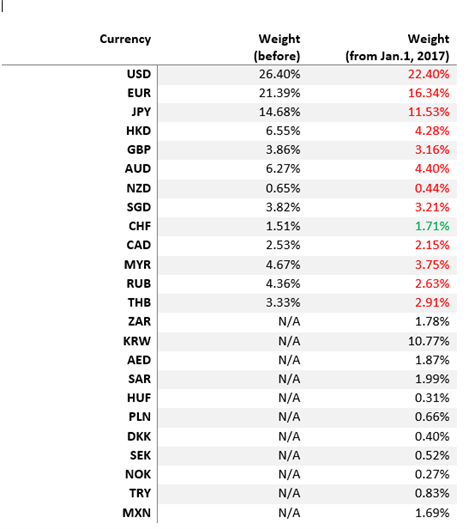

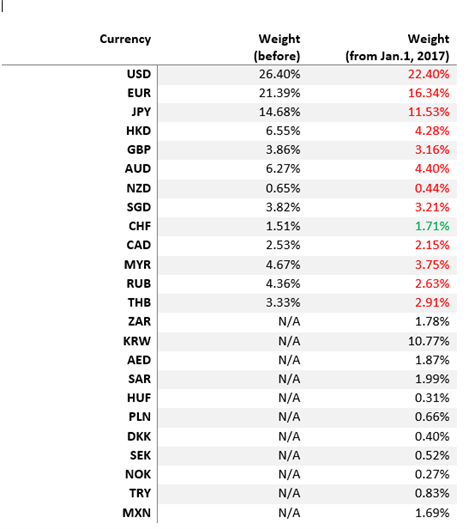

- China Foreign Exchange Trade System (CFETS), the FX trading platform operator, announced on Thursday that it will adjust the way to calculate the CFETS Yuan Index, a key measure of the Yuan against a basket of currencies, from January 1st, 2017.

The weight of the U.S. Dollar in the CFETS Yuan Index will be reduced to 22.40% from 26.40% and the Euro’s will be cut to 16.34% from 21.39%; 11 new currencies will be added into the index, including the South Korean Won, a long-suggested currency to the trade-weighted basket, as South Korea is the fifth largest trading partner to China. CFETS told that it will assess the currency basket on an annualized basis and adjust the composition of the basket and corresponding weights according to changes in international trade weights.

- China’s onshore liquidity mechanism is facing a problem: despite that the Central Bank has been injecting cash into the interbank market, non-bank institutions remain in short of liquidity as banks have tightened credit issuance to them in the effort to curb banks’ own risks.

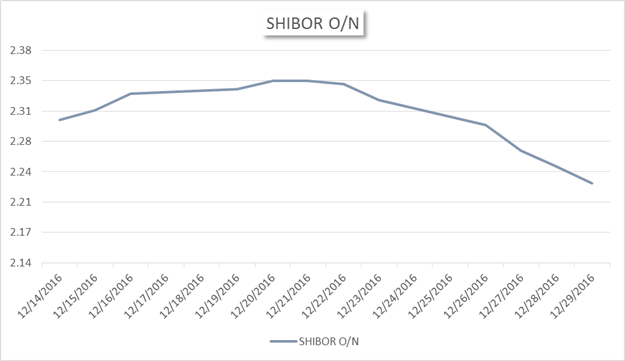

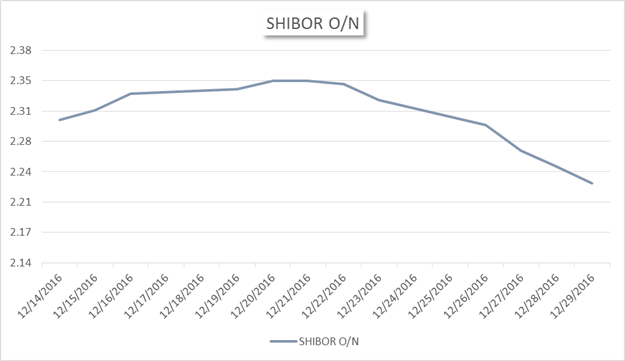

The overnight Yuan borrowing rate in Shanghai interbank market began to drop since last week: SHIBOR O/N fell from 2.345% on December 21st to 2.227% on December 29th, which indicates that conditions for banks to meet their imminent-term liquidity need have improved.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

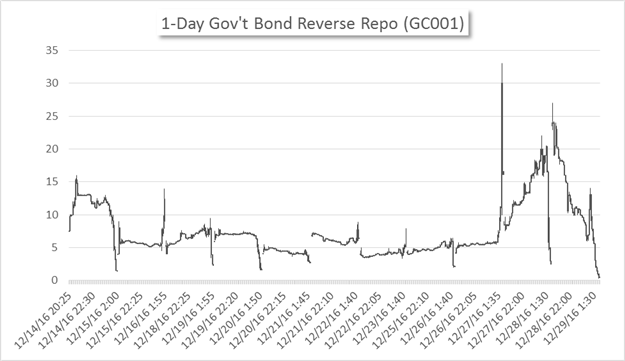

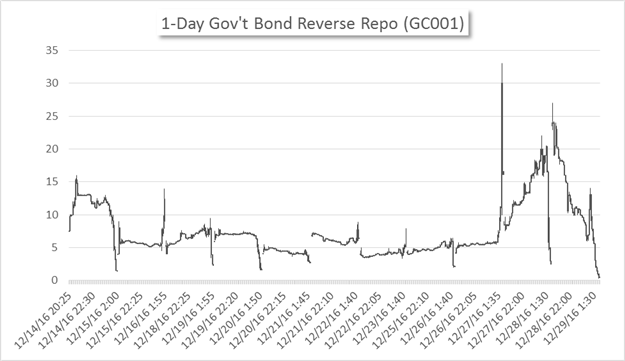

However, for non-bank institutions, they are still struggling to cover shortfalls in cash which normally gets worse as it approach to the year end. On December 27th, the 1-day government bond reverse repo rate jumped to 33.00% in the afternoon session and closed at 18.55%, the second highest level this year (the highest was 35.41% on September 29th). The rate remained elevated and volatile on Wednesday and early Thursday before dropped to 0.55% at Thursday close.

Investors in government bond reverse repos are generally individual or non-bank institutional investors. The soaring rate indicates that non-bank institutions were not able to borrow from banks and therefore had to seek alternatives, such as through government bond reverse repos.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

This is not the first time that China’s liquidity mechanism encountered trouble recently. On December 15th, both 5-year and 10-year government bond futures plunged and suspended in trading, triggered by Fed rate hike and market rumors; yet, a root cause is that banks tightened credit issuance to non-bank institutions. One of the regulator’s responses on that day was guiding banks to lend to non-bank institutions.

Within such context, China’s Central Bank is less likely to cut the reserve requirement ratio soon, despite of increasing speculations on it. Pumping more water into a clogged tube not only may fail to feed dry areas but could also flood somewhere else, such as the property market, which has already attracted too much cash, fueling price bubbles.

Market News

Hexun News: Chinese leading online media of financial news.

- China’s Finance Ministry held the annual meeting on December 29th to set the agenda for 2017. The Finance Minister Xiao Jie said that the department will expand fiscal spending appropriately, continue to cut taxes and fees and make sure economic growth to fall within a reasonable range next year.

Normally, China state agencies will hold meetings following the Central Economic Work Conference and set their plans and targets accordingly.

China Finance Information: a finance online media administrated by Xinhua Agency.

- State-owned enterprises (SOEs)’s debt-to-asset ratio rebounded to a high of 61.6% in November, following drops in two months in a row, according to China’s statistics bureau. This indicates that SOEs have not made substantial progress in reducing leverage. On the contrary, the debt-to-asset ratio of private-owned companies continued to fall in November, down -0.2% to 51.1%. In terms of profits, SOE’s growth increased to 8.2% from 4.8% in the month prior while the growth of private-owned companies dropped to 5.9% from 6.6%; this is the first time in six years that SOE’s profits expanded faster than private-owned companies’.

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/china_news/2016/12/29/Chinas-Market-News-China-Expands-CFETS-Yuan-Basket-Cuts-Dollars-Weight.html?utm_source=AWeber&utm_medium=Mu&utm_campaign=em

Thursday, Dec 29, 2016 10:59 am -08:00

by Renee Mu, Currency Analyst

This daily digest focuses on Yuan rates, major Chinese economic data, market sentiment, new developments in China’s foreign exchange policies, changes in financial market regulations, as well as market news typically available only in Chinese-language sources.

- U.S. Dollar, Euro, Yen, and Pound’s weights in CFETS Yuan Index have been reduced.

- China’s liquidity mechanism shows a clogging issue: non-bank institutions unable to borrow from banks.

- If you’re looking for more trading ideas, check out our Trading Guides.

- China Foreign Exchange Trade System (CFETS), the FX trading platform operator, announced on Thursday that it will adjust the way to calculate the CFETS Yuan Index, a key measure of the Yuan against a basket of currencies, from January 1st, 2017.

The weight of the U.S. Dollar in the CFETS Yuan Index will be reduced to 22.40% from 26.40% and the Euro’s will be cut to 16.34% from 21.39%; 11 new currencies will be added into the index, including the South Korean Won, a long-suggested currency to the trade-weighted basket, as South Korea is the fifth largest trading partner to China. CFETS told that it will assess the currency basket on an annualized basis and adjust the composition of the basket and corresponding weights according to changes in international trade weights.

- China’s onshore liquidity mechanism is facing a problem: despite that the Central Bank has been injecting cash into the interbank market, non-bank institutions remain in short of liquidity as banks have tightened credit issuance to them in the effort to curb banks’ own risks.

The overnight Yuan borrowing rate in Shanghai interbank market began to drop since last week: SHIBOR O/N fell from 2.345% on December 21st to 2.227% on December 29th, which indicates that conditions for banks to meet their imminent-term liquidity need have improved.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

However, for non-bank institutions, they are still struggling to cover shortfalls in cash which normally gets worse as it approach to the year end. On December 27th, the 1-day government bond reverse repo rate jumped to 33.00% in the afternoon session and closed at 18.55%, the second highest level this year (the highest was 35.41% on September 29th). The rate remained elevated and volatile on Wednesday and early Thursday before dropped to 0.55% at Thursday close.

Investors in government bond reverse repos are generally individual or non-bank institutional investors. The soaring rate indicates that non-bank institutions were not able to borrow from banks and therefore had to seek alternatives, such as through government bond reverse repos.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

This is not the first time that China’s liquidity mechanism encountered trouble recently. On December 15th, both 5-year and 10-year government bond futures plunged and suspended in trading, triggered by Fed rate hike and market rumors; yet, a root cause is that banks tightened credit issuance to non-bank institutions. One of the regulator’s responses on that day was guiding banks to lend to non-bank institutions.

Within such context, China’s Central Bank is less likely to cut the reserve requirement ratio soon, despite of increasing speculations on it. Pumping more water into a clogged tube not only may fail to feed dry areas but could also flood somewhere else, such as the property market, which has already attracted too much cash, fueling price bubbles.

Market News

Hexun News: Chinese leading online media of financial news.

- China’s Finance Ministry held the annual meeting on December 29th to set the agenda for 2017. The Finance Minister Xiao Jie said that the department will expand fiscal spending appropriately, continue to cut taxes and fees and make sure economic growth to fall within a reasonable range next year.

Normally, China state agencies will hold meetings following the Central Economic Work Conference and set their plans and targets accordingly.

China Finance Information: a finance online media administrated by Xinhua Agency.

- State-owned enterprises (SOEs)’s debt-to-asset ratio rebounded to a high of 61.6% in November, following drops in two months in a row, according to China’s statistics bureau. This indicates that SOEs have not made substantial progress in reducing leverage. On the contrary, the debt-to-asset ratio of private-owned companies continued to fall in November, down -0.2% to 51.1%. In terms of profits, SOE’s growth increased to 8.2% from 4.8% in the month prior while the growth of private-owned companies dropped to 5.9% from 6.6%; this is the first time in six years that SOE’s profits expanded faster than private-owned companies’.

https://www.dailyfx.com/forex/fundamental/daily_briefing/daily_pieces/china_news/2016/12/29/Chinas-Market-News-China-Expands-CFETS-Yuan-Basket-Cuts-Dollars-Weight.html?utm_source=AWeber&utm_medium=Mu&utm_campaign=em

» Intensive US movements on the Iraqi-Syrian border.. Where is the situation heading? - Urgent

» Iraqi Minister of Water Resources speaks to Al Jazeera Net about solutions to the water crisis

» utube MM&C 9/26/24 Iraq Dinar News-Iraq Plans Redenomination of Currency-Value of it Related-Elect

» utube 9/28/24 MM&C IQD Update News -Iraq PM - $83 Billion 3 Years - Stability - Global Contracts -

» Iraqi Foreign Ministry: Expanding the scope of war in the region leads to serious consequences

» /Information/ reveals the location of the Rafidain Bank robbers in Ramadi

» Al-Sudani Office for /Al-Maalouma/: Foreign workers threaten graduates

» Foreign Minister invites his Venezuelan counterpart to visit Baghdad

» "Government" real estate loans with amounts up to 150 million dinars.. Conditions and details

» Setting a date to launch 102 investment opportunities in Iraq

» Bitcoin Set to Post Best September Ever on Rate Cut

» What is the truth about the existence of a naval embargo imposed on Iraq?

» More than $70 million in Iraqi imports of Indian tea

» Oil price decline: Impact hits new groups in Iraq

» Parliamentary Finance to NINA: The decline in global oil prices will not affect employees’ salaries

» Al-Hakim: Investing in tourism as one of the sources of financial revenues for the state

» From Najaf Al-Ashraf.. The Minister of Labor announces the completion of the procedures for issuing

» Parliamentary Finance to NINA: The decline in global oil prices will not affect employees’ salaries

» 19,000 dinars difference from the official price.. The dollar falls slightly in Baghdad

» Al-Asadi: We call on citizens to invest in the retirement and social security law

» “Worth $4 billion”: Iran exports engineering services to Iraq

» US, Iraq agree to end 'alliance' in September 2025

» New tax will push house prices up, Iraq's real estate market into recession

» It is black and includes Iraq.. Netanyahu waves the “curse map” before the United Nations

» “The wiretapping scandal” complicates the political scene.. The second term is far from Al-Sudani

» Suspicions surround hospital projects.. Is corruption hindering the Chinese agreement in Iraq?

» Statement issued by the media office of Dr. Iyad Allawi

» Faeq Zidane: The jurisdiction of law and judiciary is a constitutional and legal jurisdiction

» Sudanese arrives in Baghdad

» Planning: Completion of 70% of inventory and numbering work in Kirkuk

» Rafidain Bank announces granting real estate loans to three categories

» Dollar price today

» Netanyahu enters with maps and attendees leave the General Assembly session.. What did he mention Ir

» The historic agreement on international withdrawal... a turning point in the path of Iraqi sovereign

» Includes citizens, employees and retirees.. A real estate loan from Rafidain worth 150 million dinar

» Does it include an American withdrawal? Two important indications in the statement "ending the missi

» Dollar exchange rates drop in Iraqi stock exchanges

» Will the drop in oil affect only employees' salaries or all segments of society?

» North Carolina removes 747,000 from voter rolls

» The full extent of the Biden-Harris criminal alien invasion REVEALED

» utube 9/24/24 MM&C Iraqi Dinar News-IRAQ-INTERNATIONALISM NY-2023 to 2029 Road Map - Social- Finan

» Hanoun calls for benefiting from the Chinese economic experience and linking the Silk Road between t

» Gulf-American statement directs a strict request to Iraq

» Conflict escalates in the Middle East, warning of Iraq slipping deeper into confrontation

» EU 'concerned' over increasing executions in Iraq

» Mustafa Sand: The judiciary has proven the “wiretapping” issue, and Al-Sudani’s brother is involved

» Parliamentary Committee Talks in Numbers About Iraq’s Water Crisis with Türkiye and Proposes a Solut

» Why did the Central Bank hesitate to implement the measures taken against Iraqi private banks?

» US State Department: Announcement of agreement on the future of the international coalition from Ira

» Housing Crisis in Iraq: “Ambitious” Government Plans and Fears of Monopoly

» Will privatization save Iraq's economy or open the door to corruption?

» Parliament: Agreement with the regional government to review its oil contracts to adapt them constit

» Interior Minister: Iraq is free of drug factories

» Anbar Alliance: Halbousi clings to power because he fears opening major files against him

» Rising prices of oil derivatives in Kurdistan.. reasons and goals

» Economist calls on the government to resort to tax exemption

» Iraqi Oil Company for Investment and Pricing of Raw Gas Produced

» Increase in activity at Mandali border crossing during the current year

» MP: New cities map will include eight governorates next year

» The Ministry of Finance confirms that the employee is entitled to university service allowances whil

» Media Commission and Starlink discuss cooperation prospects to provide internet services in Iraq

» Prime Minister: Iraq is witnessing an urban and economic renaissance and revitalization of the indus

» Kurdistan Finance announces the results of its delegation's recent visit to Baghdad

» "We will guarantee your rights".. A specialized committee reassures the drilling company's cadres af

» Iraq discusses cooperation with SpaceX to provide internet services

» Among them are young people.. the most prominent groups included in the distribution of housing unit

» Labor announces the direct transfer of 12 thousand beneficiaries to contracts in the Ministry of Int

» Al-Samarrai praises Al-Sudani’s speech before the United Nations: It is worthy of Iraq, its history

» Iraqi expert raises the principle of "no return" in Lebanon: We are facing the hypocrisy of the larg

» New tax will push house prices up, Iraq's real estate market into recession

» Iraqi oil returns to the red zone, affected by the collective decline in prices

» “Iraq at a Crossroads”… Will Climate Change Become an Opportunity for Innovation and Sustainability?

» Masrour Barzani to Parliamentary Finance: Halting oil exports caused Iraq to lose $19 billion

» 1291 projects stuck in Iraq.. achievements on paper and ruins on the ground!

» Violated Childhood.. Iraq suffers from the absence of law and the continuation of the cycle of viole

» Chinese Ambassador: We are determined to provide support to Iraq regarding armament and developing m

» Activating electronic services in the presidencies of the courts of appeal

» Trump threatens to turn Iran's largest cities into rubble.. Iraqi expert explains

» Parliamentary Finance Delegation Visits Kurdistan.. Salaries, Oil and Ports Files on the Table of Ba

» Iraqi bank achieves “achievement” in electronic transactions

» State of Law: The coming days are fateful for America and its interests in the region

» Iraq announces sending 75 tons of medical aid to Lebanon by air

» Economist reveals reasons for the return of the dollar's rise in Iraq

» Conflict escalates in the Middle East, warning of Iraq slipping deeper into confrontation

» Labor announces the direct transfer of 12 thousand beneficiaries to contracts in the Ministry of Int

» Faeq Zidane: The jurisdiction of law and judiciary is a constitutional and legal jurisdiction

» Iraq signs with Jordan the second amendment to the electricity sales contract

» US-Gulf meeting stresses importance of Iraq's respect for Kuwait's sovereignty

» New information about "the arrival of 40,000 Iraqi and Yemeni fighters to the Golan"... and Assad is

» 71,000 barrels per day.. Iraqi oil exports decreased last month

» Does the “Right to Information” Law restrict freedoms? Why weren’t journalists involved in its formu

» Zidane: The judiciary considers issues of a political nature imposed by the constitution and the law

» Engineers apply new tech to model deadly brain tumors

» Iraqi banks cause citizens to “reluctantly” take out loans to purchase solar energy systems for home

» What are the reasons behind the "weakness" of imports of goods from Iraq?

» Iran announces exporting $4 billion worth of technical engineering services to Iraq

» Social Protection: Red tape hinders access to support, Ministry of Labor adopts new initiatives

» Parliamentary Committee: There are people controlling investment in Iraq