Is Puerto Rico Another Greece? 10 Questions

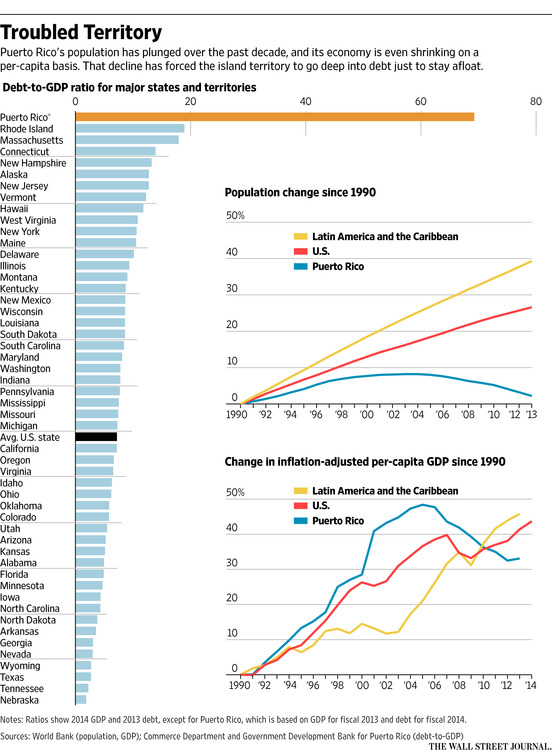

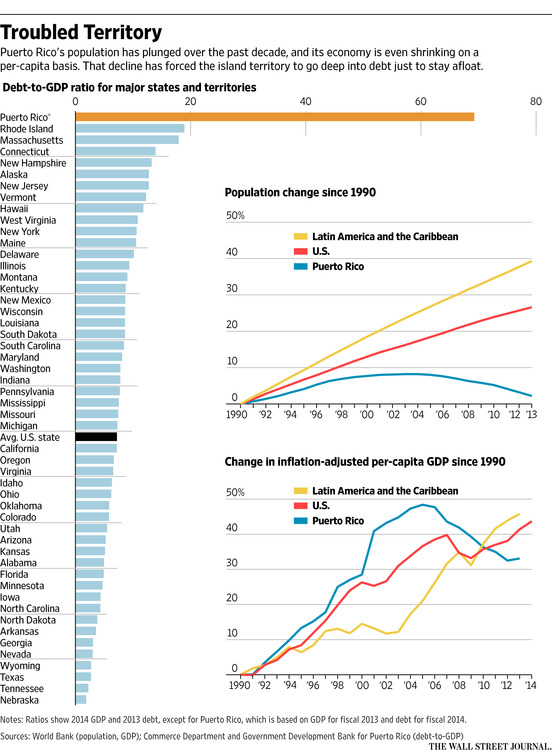

Greece isn’t the only country warning that it can’t pay its creditors. The government of the U.S. commonwealth of Puerto Rico said Monday that it won’t be able to repay debts it has piled up over the past decade.

Greece isn’t the only country warning that it can’t pay its creditors. The government of the U.S. commonwealth of Puerto Rico said Monday that it won’t be able to repay debts it has piled up over the past decade.

Here’s a quick tour of what’s happening there.

How did Puerto Rico end up like this?

Puerto Rico’s problems date to the end of the Cold War, when the U.S. began closing military bases on the island, whose residents have American citizenship but don’t pay federal tax on their local income.

The expiration of corporate tax breaks in 2006 prompted an exodus of businesses, throwing the island into a recession. Puerto Rico had a severe housing bust, and the 2007-09 recessions in the U.S., the island’s biggest trading partner, hit the commonwealth hard.

What did Puerto Rico do in response?

The government borrowed heavily to balance its budget and has run deficits, which are prohibited for most states, for the past decade. It has around $72 billion in debt outstanding, up from $24 billion in 2000.

How is the economy doing now?

Not well. Puerto Rico’s economy has been in recession for nine years. The island’s economic problems are well documented in [url=http://recend.apextech.netdna-cdn.com/docs/editor/Informe Krueger.pdf]a report Puerto Rico’s government released Monday[/url] by Anne Krueger, a former top official at the International Monetary Fund and a report last year by the Federal Reserve Bank of New York. Among the highlights:

The Krueger report concludes that high labor and infrastructure costs have discouraged investment in labor intensive sectors such as tourism. The number of hotel beds on the island is the same as the 1970s, the report notes, and tourist arrivals are actually lower today than a decade ago. Meanwhile, the government has had to rely heavily on tax breaks to lure high-value, capital-intensive industries such as pharmaceutical- and medical-device makers.

In a symbolic irony, budget discussions in the island’s Senate last week were delayed when the electric system malfunctioned and then interrupted when pieces of the decorative ceiling in the chamber began to fall.

If Puerto Rico has so many problems, why did creditors lend to Puerto Rico so generously?

Congress facilitated Puerto Rico’s borrowing spree by granting the commonwealth the power to issue bonds that are exempt from federal, state and local taxes, unlike for debt of the 50 states. This made the island’s debt attractive to affluent investors in states with higher tax rates.

Detroit filed for bankruptcy protection in 2013. Is that where Puerto Rico is headed?

No, not unless Congress amends bankruptcy law. As a commonwealth, it lacks the tools available to U.S. municipalities to restructure their debt through Chapter 9 of the bankruptcy code.

A bill introduced in Congress last year would grant the island the ability to allow its public authorities to access Chapter 9 protections, but the bill hasn’t moved anywhere amid resistance from some creditors and conservative Republican lawmakers. The White House on Monday said it supported the effort to change the bankruptcy law.

Separately, a federal judge earlier this year voided a local law that would have cleared a path to restructuring for public authorities including the electric utility.

Neither of these fixes allow the government to restructure some $22 billion in general obligation debt, which the Puerto Rican constitution says must be paid. But it’s possible that by restructuring some of the debt issued by municipal authorities, Puerto Rico might be able to access debtor-in-possession financing, a form of credit for entities in financial distress.

What about a financial control board?

On Capitol Hill, at least one lawmaker has suggested creating a federal control board, which Congress used in the late 1990s to clean up finances for the District of Columbia. That option doesn’t sit well in Puerto Rico, where it conjures overtones of colonial rule.

Could this crisis spread to other parts of the bond market or financial system?

Puerto Rico’s bonds are largely held by U.S. mutual funds and hedge funds, not banks. Analysts say the crisis doesn’t appear likely to spill over to the rest of the $3.7 trillion municipal-bond market because the economic problems are specific to Puerto Rico. That could change, however, if bond guarantors that have insured Puerto Rico’s debt suffer losses that raise questions about their ability to pay claims on other insured debt.

Can the Treasury or Federal Reserve offer a lifeline?

The Obama administration says loan guarantees or other bailouts aren’t an option, and most observers believe that the Fed would be highly unlikely to provide support to Puerto Rico without approval from the Treasury.

A report from Arturo Estrella, a former Fed economist, last week said that the Federal Reserve has legal authority to extend lifelines to the island’s public authorities. But the Fed has probably determined that Puerto Rico “is not a systemic risk to the United States, and that’s what they’re really interested in,” said Sergio Marxuach, policy director at the Center for a New Economy in San Juan.

Treasury, for its part, may be reluctant to act because other states and cities have fiscal headaches of their own, and they will want to avoid setting uncomfortable precedents in Puerto Rico.

Where does that leave the island?

Without Chapter 9, any restructuring is likely to be a legal and political mess. Because the commonwealth’s general obligation debt is constitutionally privileged, some observers believe the government may try to claw back taxes and other revenues that back different bonds.

Moreover, because bonds have been issued both in Puerto Rico and in New York, any resulting litigation could play out in different jurisdictions. “That would be the worst possible scenario—litigating in multiple places,” Mr. Marxuach said.

With Chapter 9, the threat of restructuring would give the commonwealth greater leverage in negotiation with its creditors, said Richard Ravitch, the former New York lieutenant governor who steered New York City’s financial restructuring in the 1970s.

“Thank God we never had to file, but the fact that we had the power to is what got the banks and the unions to do things they swore they would never do,” he said.

So is Puerto Rico another Greece?

There are some clear similarities. Tax evasion is rampant in both countries. A report last year estimated that as many as 44% of certain sales tax revenues in Puerto Rico went uncollected.

Neither Greece nor Puerto Rico can devalue its currency. And both appear to have lost the confidence of bond investors after amassing debt, including large unfunded pension liabilities, that helped paper over deeper economic problems.

But the two are by no means identical. Greece’s debt burden is much bigger. Its economy has been in a much deeper slump and accounts for a greater share of the eurozone than Puerto Rico’s does relative to the U.S.

Unlike Greece, Puerto Rico doesn’t face a banking crisis because its banks have federally insured deposits and access to federally insured mortgages. Its debt is also largely held by private investors, increasingly hedge funds that were well aware of the island’s fiscal troubles, while Greece’s debt is held by the IMF and public creditors in Europe.

RICARDO ARDUENGO/ASSOCIATED PRESS

Here’s a quick tour of what’s happening there.

How did Puerto Rico end up like this?

Puerto Rico’s problems date to the end of the Cold War, when the U.S. began closing military bases on the island, whose residents have American citizenship but don’t pay federal tax on their local income.

The expiration of corporate tax breaks in 2006 prompted an exodus of businesses, throwing the island into a recession. Puerto Rico had a severe housing bust, and the 2007-09 recessions in the U.S., the island’s biggest trading partner, hit the commonwealth hard.

What did Puerto Rico do in response?

The government borrowed heavily to balance its budget and has run deficits, which are prohibited for most states, for the past decade. It has around $72 billion in debt outstanding, up from $24 billion in 2000.

How is the economy doing now?

Not well. Puerto Rico’s economy has been in recession for nine years. The island’s economic problems are well documented in [url=http://recend.apextech.netdna-cdn.com/docs/editor/Informe Krueger.pdf]a report Puerto Rico’s government released Monday[/url] by Anne Krueger, a former top official at the International Monetary Fund and a report last year by the Federal Reserve Bank of New York. Among the highlights:

- Workers are discouraged from taking jobs because the welfare system provides generous benefits and businesses are disinclined to hire low-skill workers because the federal minimum wage is high relative to local income.

- Lack of employment opportunities has spawned migration to the U.S.

- Business investment is poor because electricity and transportation is unusually expensive.

The Krueger report concludes that high labor and infrastructure costs have discouraged investment in labor intensive sectors such as tourism. The number of hotel beds on the island is the same as the 1970s, the report notes, and tourist arrivals are actually lower today than a decade ago. Meanwhile, the government has had to rely heavily on tax breaks to lure high-value, capital-intensive industries such as pharmaceutical- and medical-device makers.

In a symbolic irony, budget discussions in the island’s Senate last week were delayed when the electric system malfunctioned and then interrupted when pieces of the decorative ceiling in the chamber began to fall.

If Puerto Rico has so many problems, why did creditors lend to Puerto Rico so generously?

Congress facilitated Puerto Rico’s borrowing spree by granting the commonwealth the power to issue bonds that are exempt from federal, state and local taxes, unlike for debt of the 50 states. This made the island’s debt attractive to affluent investors in states with higher tax rates.

Detroit filed for bankruptcy protection in 2013. Is that where Puerto Rico is headed?

No, not unless Congress amends bankruptcy law. As a commonwealth, it lacks the tools available to U.S. municipalities to restructure their debt through Chapter 9 of the bankruptcy code.

A bill introduced in Congress last year would grant the island the ability to allow its public authorities to access Chapter 9 protections, but the bill hasn’t moved anywhere amid resistance from some creditors and conservative Republican lawmakers. The White House on Monday said it supported the effort to change the bankruptcy law.

Separately, a federal judge earlier this year voided a local law that would have cleared a path to restructuring for public authorities including the electric utility.

Neither of these fixes allow the government to restructure some $22 billion in general obligation debt, which the Puerto Rican constitution says must be paid. But it’s possible that by restructuring some of the debt issued by municipal authorities, Puerto Rico might be able to access debtor-in-possession financing, a form of credit for entities in financial distress.

What about a financial control board?

On Capitol Hill, at least one lawmaker has suggested creating a federal control board, which Congress used in the late 1990s to clean up finances for the District of Columbia. That option doesn’t sit well in Puerto Rico, where it conjures overtones of colonial rule.

Could this crisis spread to other parts of the bond market or financial system?

Puerto Rico’s bonds are largely held by U.S. mutual funds and hedge funds, not banks. Analysts say the crisis doesn’t appear likely to spill over to the rest of the $3.7 trillion municipal-bond market because the economic problems are specific to Puerto Rico. That could change, however, if bond guarantors that have insured Puerto Rico’s debt suffer losses that raise questions about their ability to pay claims on other insured debt.

Can the Treasury or Federal Reserve offer a lifeline?

The Obama administration says loan guarantees or other bailouts aren’t an option, and most observers believe that the Fed would be highly unlikely to provide support to Puerto Rico without approval from the Treasury.

A report from Arturo Estrella, a former Fed economist, last week said that the Federal Reserve has legal authority to extend lifelines to the island’s public authorities. But the Fed has probably determined that Puerto Rico “is not a systemic risk to the United States, and that’s what they’re really interested in,” said Sergio Marxuach, policy director at the Center for a New Economy in San Juan.

Treasury, for its part, may be reluctant to act because other states and cities have fiscal headaches of their own, and they will want to avoid setting uncomfortable precedents in Puerto Rico.

Where does that leave the island?

Without Chapter 9, any restructuring is likely to be a legal and political mess. Because the commonwealth’s general obligation debt is constitutionally privileged, some observers believe the government may try to claw back taxes and other revenues that back different bonds.

Moreover, because bonds have been issued both in Puerto Rico and in New York, any resulting litigation could play out in different jurisdictions. “That would be the worst possible scenario—litigating in multiple places,” Mr. Marxuach said.

With Chapter 9, the threat of restructuring would give the commonwealth greater leverage in negotiation with its creditors, said Richard Ravitch, the former New York lieutenant governor who steered New York City’s financial restructuring in the 1970s.

“Thank God we never had to file, but the fact that we had the power to is what got the banks and the unions to do things they swore they would never do,” he said.

So is Puerto Rico another Greece?

There are some clear similarities. Tax evasion is rampant in both countries. A report last year estimated that as many as 44% of certain sales tax revenues in Puerto Rico went uncollected.

Neither Greece nor Puerto Rico can devalue its currency. And both appear to have lost the confidence of bond investors after amassing debt, including large unfunded pension liabilities, that helped paper over deeper economic problems.

But the two are by no means identical. Greece’s debt burden is much bigger. Its economy has been in a much deeper slump and accounts for a greater share of the eurozone than Puerto Rico’s does relative to the U.S.

Unlike Greece, Puerto Rico doesn’t face a banking crisis because its banks have federally insured deposits and access to federally insured mortgages. Its debt is also largely held by private investors, increasingly hedge funds that were well aware of the island’s fiscal troubles, while Greece’s debt is held by the IMF and public creditors in Europe.

» utube 11/19/24 MM&C MM&C-News-Report-Census-Global Transparency-Budget-Trade-Banking-Delete the Ze

» utube 11/18/24 MM&C IQD News Report - Contracts - Projects - Non Oil Revenue Streams - Activating

» North Gas announces resumption of production line (1000) after maintenance is completed

» Economist: The government is relying on weak reasons to diversify non-oil sources

» Parliamentarian reveals secrets of railway investment

» Iraqi Prime Minister: Tomorrow we will take an important step that has been delayed for years

» Federal decisions threaten to shut down two thousand factories and disrupt a quarter of a million jo

» First government comment on Israel's complaint against Iraq before the UN Security Council

» Turkish Trade Minister: Development Path is the Best Corridor in the World

» The future of international trade transactions in US dollars in Iraq

» The first project to index Iraqi manuscripts digitally

» Parliamentary Security: Army Aviation College Law Ready for Voting

» Population Census.. The Path to Development

» Population census: an important tool for achieving sustainable economic development

» Knowledge Summit 2024 kicks off, sharing visions and expertise on the future of knowledge and innova

» The Minister of Interior discusses with the representative of the Secretary-General of the United Na

» Minister of Transport confirms that the development road project will pave the way for important str

» Türkiye's exports to Arab countries amounted to $40 billion in the first ten months of this year, an

» Resumption of production line (1000) in the North Gas Company

» Al-Hakim calls for enacting a law that legally protects paramedics from tribal prosecutions

» The President of the Supreme Judicial Council discusses with the Spanish Ambassador cooperation betw

» Al-Sudani: The census is the dividing line between guesses and facts to distribute wealth according

» The Speaker of the House of Representatives discusses with the Chinese Ambassador bilateral relation

» Kurdish parties set impossible conditions for participation in the new government and formation in A

» Can America limit China's influence in Iraq?

» It will be passed soon.. Revealing the most important amendments to the Anti-Narcotics Law in Iraq

» Al-Mashhadani: The general amnesty law is at the top of our priorities for the next stage

» Al-Sudani confirms the government's desire to develop the trade balance with Türkiye

» MP: No understanding on "controversial" laws, disputes continue - Urgent

» "An important achievement" .. The government reviews the most prominent advantages provided by the p

» Al-Mashhadani confirms Parliament's support for legal agreements between Baghdad and Erbil

» There is no point in changing them.. Politician: The new ministers will be nominated by the same par

» Al-Hakim calls for enacting a law that legally protects paramedics from tribal prosecutions

» Al-Sudani: The census is the dividing line between guesses and facts to distribute wealth according

» The Speaker of the House of Representatives discusses with the Chinese Ambassador bilateral relation

» The third scenario for the chaos of the Middle East.. An Iraqi movement talks about the "Al-Hawl exp

» Al-Sudani: Tomorrow we will take an important step that has been delayed for years (video)

» Al-Sadr warns the government and parliament of two "important" matters

» Iraqi-Iranian talks to implement Basra-Shalamcheh railway

» Until the end of the month.. UAE announces cancellation of flights to Baghdad

» Foreign Minister: Iraq's policy is based on establishing balanced relations

» Al-Sudani: Election of Parliament Speaker helps the Council to continue performing its duties

» Revealing the details of the meeting between the President of the Republic and the Judicial Council

» Türkiye: Our relationship with Iraq included the economy in a comprehensive and broad manner

» Ministry of Commerce denies intentions to withhold food ration cards linked to population census

» Baghdad and Washington discuss the tense situation in the regional environment

» The dollar continues to rise

» Al-Sudani directs an urgent appeal to the Iraqis

» MM&C 11/17/24 For the first time in Iraq.. Efforts to establish an "Investment Association" to attr

» utube 11/16/24 MM&C-News Report-Iraq Dinar-Oil-Flow-Global Maritime Trade-Cross Border Transfer-Ex

» Global conflicts move to Iraq.. America and China fight economically in Baghdad

» Al-Sudani: Iraqi openness to comprehensive partnership with Türkiye and developing trade balance

» Accused of negligence, the Parliamentary Energy Committee calls on Al-Sudani to hold the “Baghdad El

» Al-Maliki's coalition notes Al-Sudani's performance in three files

» On charges of forgery... Al-Dulaimi complains about Al-Halbousi before the Integrity Commission

» Al-Karawi: The government mortgaged the port of Faw to companies affiliated with the Zionist entity

» Parliamentary Integrity: We will proceed with the ministerial amendment even if the government delay

» Reopening of applications to the morning private government education channel

» Bitcoin rises after weekly losses

» Al-Maliki Coalition: The government amendment does not exceed three ministerial portfolios

» Parliamentarian: Amending the Election Law is out of the question

» Israel threatens to target infrastructure in Iraq and assassinate "prominent figures"

» Parliamentary regions: Article 140 road is closed

» The Central Bank of Iraq's dollar sales increased

» Al-Alaq reviews to the President of the Republic the Central Bank’s plans to develop the banking sec

» Al-Atwani to the French Embassy delegation: Halting external borrowing indicates an improvement in I

» Parliamentary move against Kar Oil Company: Suspicions of "fake" electricity supply

» Parliamentary Health: Iraq suffers from a large surplus in the number of doctors and pharmacists by

» It causes a loss of one billion dollars per month.. A date has been set for the resumption of Kurdis

» Türkiye blames Iraq: You waste water and do not have good management in rationalizing it

» Iraq rejects “COP29” proposal: We will not get rid of fossil fuels, as they are the basis of our eco

» Bitcoin nears $90,000 after biggest drop since election

» For the first time, Iraq issues the commodity structure of exports and imports

» Procedures for (automating) the work of Baghdad International Airport

» Planning: No cuts to benefits or taxes due to census

» International organizations praise the government's national initiatives

» {Official platform} to combat rumors

» Al-Sudani: The census will be used exclusively to develop development plans

» Justice audits financial movements in its departments

» Al-Imar to {Sabah}: 3 residential cities in Baghdad to be referred soon

» Kurdistan Region of Iraq plans to receive 10 million tourists annually

» Discussion of mineral investment and export mechanisms

» Consensus on the importance of planning in achieving sustainable development

» Corporate Restructuring: Stimulating Economic Growth

» Iraq's commitment to OPEC decisions controls oil prices

» Delete zeros and evaluate the dinar

» Economists: Empowering the private sector requires a legislative system

» Preparations for holding meetings of the Iraqi-Egyptian Committee

» Parliamentary Legal Committee to Nina: Controversial and important laws will be passed in one go in

» Central Agency for Public Mobilization and Statistics to Nina: The census activities are completely

» Turkish Trade Minister to visit Iraq tomorrow, Monday, heading a delegation of businessmen

» Slight decrease in dollar exchange rates in local markets

» Basra Gas Company launches the “Safe Step” program to raise awareness of the dangers of mines and wa

» With high-level governmental and international presence... the activities of the Iraqi Digital Space

» Ministry of Oil: FCC project to produce derivatives to be completed in the middle of next year

» Does America influence the decisions to form the regional government?.. 5 critical months

» Search for remains of the eight-year war postponed until 2025.. Diggers await spring

» US forces reposition in the "Desert Triangle" in western Iraq