A Question of Money — Interest & Bankers

Posted on September 8, 2015 by Martin Armstrong

QUESTION:

Mr Armstrong, interesting article today, the story of the store of value (at least long term) has always confused me. One can look at saving accounts also as an asset as it yields the interest payment and one relinquishes the access to the money. No difference to bonds.

But your article causes some questions: as you stated before the FED buying bonds does not increase real money supply, so what caused the decline of purchasing power of money in the asset class of equities? Is it that the manipulating of interest rates distorted the actual confidence and time preference in the economy which can be measured by the velocity?

You posted earlier that the velocity has declined. People do not want to invest but save which is not an option for big money as it doesn’t yield any or very little return. Hence enterprises buy back shares and smart money has no other option.

Interest rate hike by the FED, eventually increasing retail participation, a cooling world economy, sovereign debt crisis and the flight to the Dollar. The outcome of your computer, a rise in US stock markets including a possible phase transition, seems comprehensible.

The only thing what leaves me with amazement is what do they really intend? I don’t believe that the families who run the banking system, operating for centuries in money business, do not understand that. I can only assume that for being protected by government the banking cartel buys the governments time and keep financing the deficits.

Best regards,

G

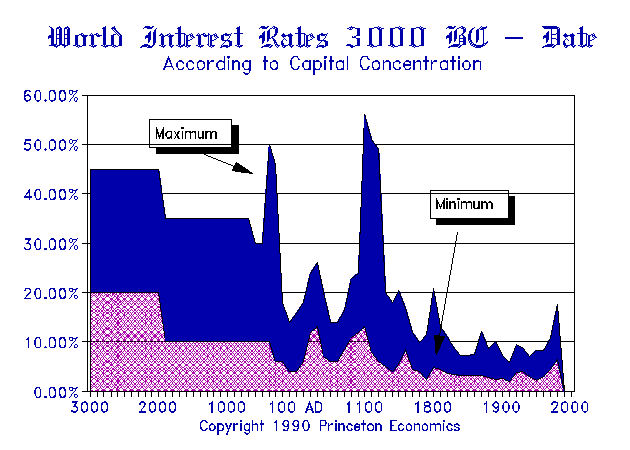

ANSWER: The problem lies in so many areas, and though we can focus on one issue, the answer is a complexity of variables. The history of interest rates is provided on this site. Interest rates in a developed economy reflect the “option” value on the expected decline in purchasing power of money. If I expect it to decline by 5%, then I expect a profit, and say want 8%. You in turn will pay the 8% only if you think you also can make a profit above 8%, perhaps 10%+.

In an UNDEVELOPED economy, we transpose the depreciation risk of money with risk in general. Lacking any developed economy, one will lend based only upon the risk of repayment. Therefore, without a legal system, the risk is either the person or the political climate. When we look at the history of interest rates, I demonstrated that the rate of interest even within the Roman Empire increased the further you moved away from Rome. Hence, the lowest interest rates are in the dollar and they rise in other countries based upon perceived political risk. Greece’s interest rates are significantly higher than Germany’s. This is a reflection of political risk, not simply the future inflation rate in the euro.

The Fed did not increase the money supply with QE easing and we have seen that nine months of QE in Europe has also failed to create inflation. What happened to the whole theory of the quantity of money impacting inflation? The problem lies in the definition. When U.S. government debt was illegal to borrow against using it as collateral, then issuing debt DID NOT increase the money supply. When that was changed and you could post T-bills as collateral to trade, then there was no longer a difference between debt and money.

After the revolution, the U.S. government did not issue paper money until the Civil War. To encourage people to accept it (CONFIDENCE), it paid interest. In reality, this was a form of a circulating bond. The term “greenback” referred to the issues that did not pay interest and were not purportedly backed by silver or gold. You turned it over and it was just green ink with no promises.

So the Fed buying in bonds did not increase the money supply and failed to create inflation as expected BECAUSE it merely swapped bonds (money paying interest) with non-interest paying money (electronic entries). The bankers then complained so the Fed created the Excess Reserve Facility, where banks have nearly $3 trillion in cash. The SF Fed argues that Milton Friedman said they should pay interest on reserves. That was only on the required reserves. The creation of the Excess Reserves totally negated the entire idea of stimulating the economy for the banks never lent the money out. It became a giant swap of bonds for cash deposits, of which the Fed then had to pay 0.25% interest.

So now turning to the VELOCITY of money: a decline here demonstrates that people are HOARDING cash (rising in purchasing power as assets decline), as well as banks (Excess Reserves). We have companies buying back their own stock, further shrinking the supply of equities, and fueling the deflationary spiral. The Excess Reserves at the Fed show just how much banks are hoarding cash.

Therefore, we can see the deflationary trend and the contraction right here. The U.S. share market has been at the high-end of trading, but it did not breakout beyond our second target of 18500 on the Dow. The market indeed doubled as we warned, coming out of the hold in the 6,000 level and passing 12,000, which is the MINIMUM requirement to start a Phase Transition. We nearly tripled by the 2015.75 target beating our minimum doubling requirement, but this was still not a Phase Transition. Why? Retail participation has been at record lows in stocks. This is a bubble in government debt — it is the reason why we are at a 5000-year low in interest rates.

Now top the conspiracy, as worded by one of our e-mailers: “The only thing that leaves me with amazement is what do they really intend? I don’t believe that the families who run the banking system, operating for centuries in money business, do not understand that. I can only assume that for being protected by government the banking cartel buys the governments time and keep financing the deficits.”

Banking establishments are some of the WORST investors throughout history. They always go bust and government devours them every single time. Yes, the government has been protecting the bankers for they have also been fueling the debt and assisting governments to borrow. Therein lies their own demise. EVERY major banking house has been destroyed by this very same flirtation with power. They are like moths attracted to the flame of a candle, hoping to dance by the light and never realizing their wings may get burned.

The cycle has changed. The wheel of fortune has completed its revolution. Governments are turning against the banks and looking to electronic currency. The days of rumored banking conspiracies are coming to an end, as it always does. The banks will be a giant short. When the Sovereign Debt defaults become a contagion, the banks will not be supported by government.

This entry was posted in Q&A, The Global Market and tagged Confidence, Dollar, ECM Proprietary Trading & Banking, Hoarding Money, Interest Rates, Sovereign Debt Default, T-Bills, Undeveloped Economies, Velocity by Martin Armstrong. Bookmark the permalink.

Posted on September 8, 2015 by Martin Armstrong

QUESTION:

Mr Armstrong, interesting article today, the story of the store of value (at least long term) has always confused me. One can look at saving accounts also as an asset as it yields the interest payment and one relinquishes the access to the money. No difference to bonds.

But your article causes some questions: as you stated before the FED buying bonds does not increase real money supply, so what caused the decline of purchasing power of money in the asset class of equities? Is it that the manipulating of interest rates distorted the actual confidence and time preference in the economy which can be measured by the velocity?

You posted earlier that the velocity has declined. People do not want to invest but save which is not an option for big money as it doesn’t yield any or very little return. Hence enterprises buy back shares and smart money has no other option.

Interest rate hike by the FED, eventually increasing retail participation, a cooling world economy, sovereign debt crisis and the flight to the Dollar. The outcome of your computer, a rise in US stock markets including a possible phase transition, seems comprehensible.

The only thing what leaves me with amazement is what do they really intend? I don’t believe that the families who run the banking system, operating for centuries in money business, do not understand that. I can only assume that for being protected by government the banking cartel buys the governments time and keep financing the deficits.

Best regards,

G

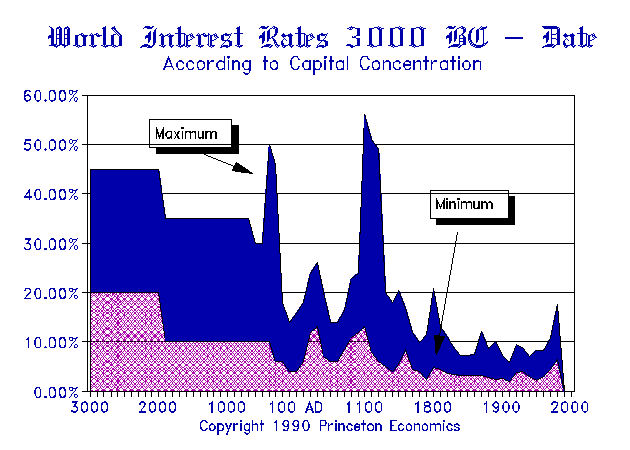

ANSWER: The problem lies in so many areas, and though we can focus on one issue, the answer is a complexity of variables. The history of interest rates is provided on this site. Interest rates in a developed economy reflect the “option” value on the expected decline in purchasing power of money. If I expect it to decline by 5%, then I expect a profit, and say want 8%. You in turn will pay the 8% only if you think you also can make a profit above 8%, perhaps 10%+.

In an UNDEVELOPED economy, we transpose the depreciation risk of money with risk in general. Lacking any developed economy, one will lend based only upon the risk of repayment. Therefore, without a legal system, the risk is either the person or the political climate. When we look at the history of interest rates, I demonstrated that the rate of interest even within the Roman Empire increased the further you moved away from Rome. Hence, the lowest interest rates are in the dollar and they rise in other countries based upon perceived political risk. Greece’s interest rates are significantly higher than Germany’s. This is a reflection of political risk, not simply the future inflation rate in the euro.

The Fed did not increase the money supply with QE easing and we have seen that nine months of QE in Europe has also failed to create inflation. What happened to the whole theory of the quantity of money impacting inflation? The problem lies in the definition. When U.S. government debt was illegal to borrow against using it as collateral, then issuing debt DID NOT increase the money supply. When that was changed and you could post T-bills as collateral to trade, then there was no longer a difference between debt and money.

After the revolution, the U.S. government did not issue paper money until the Civil War. To encourage people to accept it (CONFIDENCE), it paid interest. In reality, this was a form of a circulating bond. The term “greenback” referred to the issues that did not pay interest and were not purportedly backed by silver or gold. You turned it over and it was just green ink with no promises.

So the Fed buying in bonds did not increase the money supply and failed to create inflation as expected BECAUSE it merely swapped bonds (money paying interest) with non-interest paying money (electronic entries). The bankers then complained so the Fed created the Excess Reserve Facility, where banks have nearly $3 trillion in cash. The SF Fed argues that Milton Friedman said they should pay interest on reserves. That was only on the required reserves. The creation of the Excess Reserves totally negated the entire idea of stimulating the economy for the banks never lent the money out. It became a giant swap of bonds for cash deposits, of which the Fed then had to pay 0.25% interest.

So now turning to the VELOCITY of money: a decline here demonstrates that people are HOARDING cash (rising in purchasing power as assets decline), as well as banks (Excess Reserves). We have companies buying back their own stock, further shrinking the supply of equities, and fueling the deflationary spiral. The Excess Reserves at the Fed show just how much banks are hoarding cash.

Therefore, we can see the deflationary trend and the contraction right here. The U.S. share market has been at the high-end of trading, but it did not breakout beyond our second target of 18500 on the Dow. The market indeed doubled as we warned, coming out of the hold in the 6,000 level and passing 12,000, which is the MINIMUM requirement to start a Phase Transition. We nearly tripled by the 2015.75 target beating our minimum doubling requirement, but this was still not a Phase Transition. Why? Retail participation has been at record lows in stocks. This is a bubble in government debt — it is the reason why we are at a 5000-year low in interest rates.

Now top the conspiracy, as worded by one of our e-mailers: “The only thing that leaves me with amazement is what do they really intend? I don’t believe that the families who run the banking system, operating for centuries in money business, do not understand that. I can only assume that for being protected by government the banking cartel buys the governments time and keep financing the deficits.”

Banking establishments are some of the WORST investors throughout history. They always go bust and government devours them every single time. Yes, the government has been protecting the bankers for they have also been fueling the debt and assisting governments to borrow. Therein lies their own demise. EVERY major banking house has been destroyed by this very same flirtation with power. They are like moths attracted to the flame of a candle, hoping to dance by the light and never realizing their wings may get burned.

The cycle has changed. The wheel of fortune has completed its revolution. Governments are turning against the banks and looking to electronic currency. The days of rumored banking conspiracies are coming to an end, as it always does. The banks will be a giant short. When the Sovereign Debt defaults become a contagion, the banks will not be supported by government.

This entry was posted in Q&A, The Global Market and tagged Confidence, Dollar, ECM Proprietary Trading & Banking, Hoarding Money, Interest Rates, Sovereign Debt Default, T-Bills, Undeveloped Economies, Velocity by Martin Armstrong. Bookmark the permalink.

» Al-Alaq: The monetary situation in Iraq is excellent and our reserves support the stability of the e

» utube 11/23/24 MM&C Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Pr

» utube 11/25/24 MM&C MM&C Iraq News-CBI Building Final Touches-Oil Exports-Development Road-Turkey-B

» Parliamentary movement to include the salary scale in the next session

» Parliamentary Finance Committee reveals the budget paragraphs included in the amendment

» Al-Maliki calls on the Bar Association to hold accountable members who violate professional conduct

» Politician: The security agreement with America has many aspects

» Kurdistan Planning: More than 6 million people live in the region, the oldest of them is 126 years o

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Economics saves from political drowning

» Agriculture calls for strict ban on import of "industrial fats" and warns of health risks

» Iraq is the fourth largest oil exporter to China

» Railways continue to maintain a number of its lines to ensure the smooth running of trains

» Parliament resumes its sessions tomorrow.. and these are the most important amendments in the budget

» Bitcoin Fails to Continue Rising as It Approaches $100,000

» Minister of Planning: There will be accurate figures for the population of each governorate

» Popular Mobilization Law is ready for voting

» Mechanisms for accepting people with disabilities into postgraduate studies

» Government coordination to create five thousand jobs

» Transport: Next month, a meeting with the international organization to resolve the European ban

» Census is a path to digital government

» Calls to facilitate loans and reduce interest rates for the private sector

» The launch of the third and final phase of the "population census"

» Al-Sudani: We have accomplished a step that is the most prominent in the framework of planning, deve

» Justice discusses modern mechanisms to develop investment in real estate and minors’ money

» Dubai to host Arabplast exhibition next month

» Al-Tamimi: Integrity plays a major role in establishing the foundations of laws that will uphold jus

» Reaching the most important people involved in the "theft of the century" in Diyala

» Transportation: Completion of excavation works and connection of the immersed tunnel manufacturing b

» Between internal and regional challenges... Formation of the Kurdistan government on a "slow fire" a

» Kurdistan Region Presidency: We will issue a regional order to determine the first session of parlia

» The Minister of Foreign Affairs announces the convening of the Ambassadors Conference tomorrow, Mond

» Al-Sudani: Iraq must always be at the forefront

» Al-Mashhadani: We support the Foreign Ministry in confronting any external interference that affects

» Al-Sudani chairs meeting with Oliver Wyman delegation

» Half a million beggars in Iraq.. 90% of them receive welfare salaries

» Sudanese announces preliminary results of the general population and housing census in detail

» The centenary of the Iraqi Ministry of Foreign Affairs.. A journey of challenges and achievements

» Prime Minister's Advisor Announces Assignment of Two International Companies to Study Iraqi Banking

» Agriculture: Integrated Support Project Provides 1,333 Job Opportunities

» The Media and Education Commission discuss introducing advanced curricula related to artificial inte

» Al-Mashhadani’s First Test: Discussing Israeli Threats and Avoiding Controversial Laws

» By name.. A parliamentary bloc reveals that five ministers will be questioned at the end of the legi

» The financial budget is subject to political and economic amendments in the next parliamentary sessi

» Will the government's efforts succeed in ending the electricity crisis in Iraq?

» Baghdad Airport Customs Increased to 400% After Implementing Automation

» EU: Integrated Support Project in Iraq Creates Jobs in Agriculture and Youth

» Al-Sudani attends the centenary ceremony of the establishment of the Ministry of Foreign Affairs

» Al-Mashhadani: We seek to keep foreign policy away from alignments that harm Iraq’s unity and sovere

» The Iraqi government is working to develop a competitive banking system and support the private sect

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Regional markets rise in first session of the week

» Kurdistan Region Presidency: We will issue an order to set the first session of the regional parliam

» Political differences hinder oil and gas law legislation

» Government coordination to create new job grades for graduates

» The financial budget is subject to amendments in the next parliamentary session

» Alsumaria Newsletter: Iraq reaches the final stages of the census and Parliament resumes its session

» After the elites and workers... Iranian factories "migrate" to Iraq

» Beggars in Iraq "refuse" welfare salaries.. Their profits are 10 times the salary!

» Amending the Election Law... A Means to Restore the Dilapidated Legitimacy

» Prime Minister announces population census results, Iraq reaches 45 million mark

» Find out the dollar exchange rates in the Iraqi markets

» Kurdistan Interior Ministry: General amnesty does not include those accused of killing women

» utube 11/21/24 MM&C MM&C News Reporting-Global Trade-Best Route in World-Purchase Power-Justice-Cen

» Al-Sudani discusses with the Secretary-General of the Digital Cooperation Organization enhancing dig

» President of the Republic: Partnership with the United States is essential to achieve regional stabi

» Mazhar Saleh reveals details of the 2023 budget and the 2024 budget horizon

» Absent control and rising corruption.. Sudan faces a harsh political winter

» A representative shows the laws prepared for voting during the upcoming sessions.

» Corrupt people in it.. Independent MP criticizes the performance of Al-Sudani's government

» Parliamentary Oil Committee reveals government move to end electricity crisis

» The Administrative Court postpones consideration of the lawsuit on the legitimacy of the Kirkuk gove

» MP: The ministerial reshuffle depends on consensus within the state administration

» Politicians put question marks on Al-Sudani: corruption, espionage and serving foreign interests

» The International Union of Arab Bankers honors the Chairman of the Private Banks Association: A prom

» Industry: Contracts to supply state ministries with food products

» After Shell Withdrawal, American Company Heads to Implement Al-Nibras Project in Iraq

» Revealing the fate of the Chinese deal in Iraq.. It was disrupted by this party

» The Central Bank of Iraq 77 years of challenges and reforms

» "Unprecedented numbers"... American "CNN" talks about tourism in Iraq

» After implementing automation, Baghdad Airport Customs jumps 400 percent

» Iraq participates in sustainable development activities

» Al-Sudani opens 790 model schools

» Parliamentary Culture: The Right to Information Law will satisfy all parties

» Al-Mashhadani to {Sabah}: Tomorrow we will discuss the Zionist threats

» Industry to {Sabah}: Contracts to supply state ministries with food products

» Trade cooperation between Najaf and Isfahan

» {New building} and {electronic systems} to develop forensic medicine

» A specialized center for monitoring the environmental situation in the capital

» International and parliamentary praise for the success of the "population census" process

» The European Union organizes a workshop in Basra on central administration and the wealth distributi

» The Media Authority and the Ministry of Education discuss the importance of enhancing and introducin

» Iraq's oil exports to America rose last week

» Electricity announces loss of 5,500 megawatts due to complete halt of Iranian gas supplies

» Tomorrow.. The Arab League is looking to unify its position against Israeli intentions to strike Ira

» The Central Bank moves its secret vaults to its new building.. Clarification of the truth of the cla

» Network reveals the fate of the Chinese deal.. It was disrupted by "Iraqi officials"

» From the White House to the "Leaders of Iraq"... A Message Regarding the Targeting of Baghdad