Market Manipulation Confusion

Posted on November 13, 2015 by Martin Armstrong

QUESTION: You say that long-term manipulations are impossible while short-term manipulations have been the focus of the bankers. Do you mean to say that not even governments can manipulate the economy perpetually? Are central banks buying US equities to manipulate the US stock market higher? It would seem that the Fed would then be accused of creating a bubble. What is going on?

Thank you.

PH

ANSWER: The age of “New Economics”, as Volcker put it, ended with the collapse of Bretton Woods and the crash of 1974. Of course, governments have tried to manipulate society and the economy. All governments operate out of their self-interest and impose punishment as their weapon. They falsify the statistics, revising them routinely, especially CPI after learning that everything is indexed to CPI. So if you reduce the CPI, you cut benefits without having to confront the people. After 1980, they removed real estate, which they considered an investment opposed to an associated cost of living, and replaced it with rent.

The entire game of societal manipulation is to maintain their power. They historically will do whatever they need to do to achieve that goal. They routinely manipulate the truth through the press. Nobody will report that the Clintons removed ALL restraints against the banks from Intrastate Banking to Glass-Steagall, or the fact that they also made student loans non-dischargeable in bankruptcy at the bankers’ request so that they could securitize them. Nobody will bring that up to Hillary because she is the favorite of the press. They attack Ben Carson and Trump all the time, but Hillary, they assume, is a coronation.

There is a HUGE difference from claiming these private persons or governments CAN manipulate everything indefinitely and realizing that no matter who they are they CANNOT perpetually manipulate society or the economy. If the former is true, then there would be no crash and burn – just a flat-line. Sorry, people may not like that statement, but there is no proof that ANYTHING has been perpetually suppressed indefinitely. Too many people say that the markets are perpetually manipulated, as if it were simply a fact, yet they tell others to buy them anyhow. They cannot offer any proof that would stand up in a court, yet anyone who disagrees is evil and dangerous.

Society is typically manipulated by government in cycles: 26 years (most common), 31 years (as proprietary trading), or the most extreme manipulation that follows the volatility models of 72 years (communism). When it comes to the collapse of the monetary system (sovereign defaults), we are looking at 10 x the 8.6, which brings us to 86 years. So from the Roosevelt devaluation of the dollar in 1934, we should see the monetary system change in 2020. There are plenty of oscillations back and forth with each interval. Nothing is ever a straight line.

The era of bank manipulations (proprietary trading) of numerous markets for SHORT-TERM plays began in 1981 and came to an end in 2013. Nobody documented market manipulations as I did. This was a huge issue in court; they threatened to throw all of my lawyers in prison unless they handed over those tapes. So, I find it ironic to claim I deny manipulations when they exaggerate everything to support their own failures.

The European banks have mostly withdrawn from manipulations. The “club” in New York is still active, but their ranks are also diminishing. This will lead to a further collapse in liquidity and that means much higher volatility.

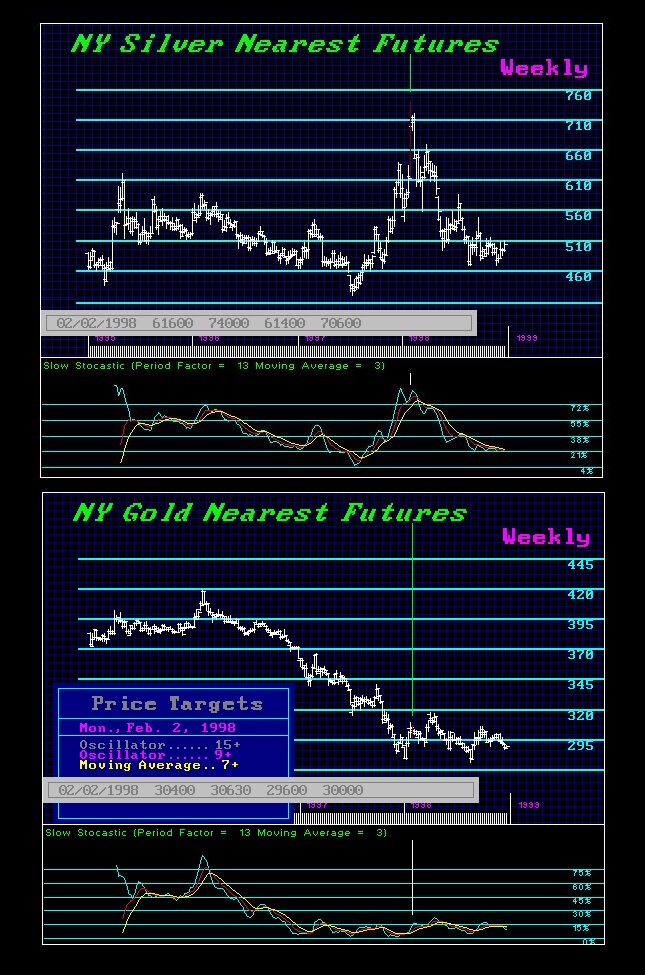

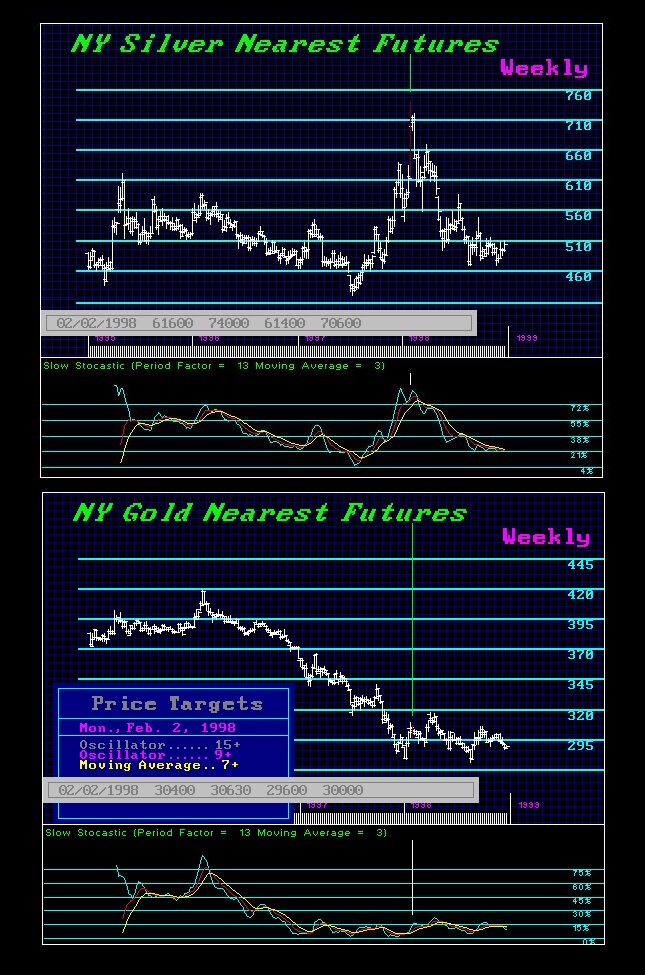

If you cannot understand the difference, then you obviously do not have any real experience. Here is a TAPED PHONE CALL that has survived on the silver manipulation before Buffett admitted to buying $1 billion in silver between himself and a dealer. The dealer was not part of the manipulation, which was ENTIRELY short-term and not perpetual.

It was on January 28, 1998, that a class action lawsuit was filed against the commodities firms that had been buying the silver. The lawsuit maintained that the price of silver was being manipulated because the price of silver was rising as gold was going down, which was an “unprecedented” occurrence. With accusations that silver prices were being manipulated and a CFTC announcement that it was looking into the accusations, Buffet’s Berkshire issued a press release on February 3, 1998, disclosing the purchase of $1 billion. Buffet denied that he was manipulating silver, yet silver still fell to new lows and the positions were sold. The professionals stepped aside. Who were the victims? Retail small investors, as always, who were sucked in by many of the same people. Ask them what their forecast was during this one. Were they analysts who said, “DON’T BUY it’s a manipulation!” or were they cheerleaders for every rally since 2011?

Audio Player

00:00

00:00

Use Up/Down Arrow keys to increase or decrease volume.

Even after Bretton Woods, there was the 1960 crash, then again in 1963, which resulted in removing silver from coinage in 1964. It crashed again in 1966, and in 1968, a two-tiered gold market began; finally in 1971 it collapsed. The Bretton Woods system was implement in 1945 when the IMF was born. What have I stated countless times?

The longest recession is 26 years. The Long Depression of the 19th century was 26 years, starting with the panic of 1873, and concluding with the peak in interest rates in 1899. Japan’s bubble peaked in 1989, and we should see a shift start next year as 2015 was 26 years down.

Nothing can be perpetually manipulated, for the free market will always create a check and balance. There is no example of a historical trend that anyone can find. Even the Latin Monetary Union of the 19th century attempted to unify several European currencies into a single currency (like the euro) but without the surrendering of sovereignty. The currencies in 1865 were standardized, so the same weight of a gold coin was interchangeable without requiring foreign exchange fees. This lasted for two pi cycles, totaling 62 years, but there were some interruptions due to war. It was disbanded in 1927, and that was not a manipulation, just a monetary union trying to create a single European currency for trade.

Governments today are desperately trying to control everything from the press onward. This is the drive to create electronic money, which is the final straw in their desperate manipulation to sustain power to force everyone into taxation.

The real MANIPULATION is not to suppress a single market – it is to control society. That is the big game afoot. It is much bigger than simply trying to suppress gold. That accomplishes nothing. Gold is the HEDGE AGAINST GOVERNMENT, and that they know. This is why they are trying to track gold movement. We are approaching the TIME when the metals will reverse. That comes ONLY when the majority loses confidence in government. We can see the trend starting to prepare, for that is why Trump is leading. It is not about him personally, it is about throwing out career politicians, which has become a global trend.

Things go nuts when the CONFIDENCE in government declines for the majority. It has nothing to do with fiat, manipulations, bankers, or whatever. It is the collapse in confidence in government.

I have shown this chart on the collapse of the Roman Monetary System many times. The collapse took place AFTER the emperor Valerian I was captured by the Persians. Can you imagine the blow to confidence if Putin captured Obama, turned him into his footstool, and the U.S. was powerless to invade? Then you would see the collapse in the dollar just as the Romans saw the collapse in their currency. It is ALWAYS a confidence game.

As far as central banks buying U.S. equities, no, they are not manipulating the market. Interest rates are way too low and equities offer a better return. Additionally, countries like Switzerland lost a fortune on the euro peg in the area of 50 billion Swiss francs. The total population of Switzerland is just over 8 million, which means they lost 6200 francs per person or about $7,000 per person at the time.

The euro is a failure. There is nothing left in the world for big money BUT the dollar. So the lack of alternative reserves have forced central banks to buy equities. They are NOT creating money to buy equities out of thin air. Anyone who claims that is revealing their lack of international knowledge and is judging the world by the Fed, who has the power to create money as an elastic money supply. I explained back in 2011 the structural difference between the ECB and the Federal Reserve.

No one who claims all central banks have the same powers has done their homework. Some central banks buy U.S. equities, sell bonds, and shift assets WITHOUT creating money. It is just not true that all central banks can create money elastically. However, many have the powers to create money to achieve Quantitative Easing, but it is not unlimited in many cases, whereas the Federal Reserve does not require Congressional approval to buy more debt since it has the power to create elastic money from the beginning.

To carry out Quantitative Easing, central banks create money by buying securities, such as government bonds from banks with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased—hence the term “quantitative” easing.

The Swiss National Bank (SNB) took a huge hit on its attempt to manipulate the currency market by creating the euro-franc peg. So if they lost money, how does this stack up if they can just print money at will? It would seem strange that they could ever lose under this scenario. The SNB had a huge loss on foreign exchange positions that were denominated in euros. These euro positions were bought in a desperate attempt to prevent the appreciation of the Swiss franc against the euro for trade purposes. However, the losses were partially offset by 10 billion in price gains on stocks and bonds in its portfolio like any other investor.

Contrary to this idea that all central banks are the same, here the SNB includes 236 million in its income derived from negative interest rates paid by depositors for holding deposits there at the central bank. This Fed can only dream of this revenue source, as the Fed pays 0.25% on excess reserves amounting to welfare for bankers.

Therefore, the huge loss on the peg is the result of mark-to-market accounting on assets, rather than just showing original cost accounting as Japan did. In its published financial statements, the SNB is required by Swiss law to mark its investments to the current market price, which includes both securities (stocks and bond holdings) and gold holdings. This is strikingly different for the Federal Reserve is not mark-to-market. The SNB on March 31 posted a net worth of 56 billion chf, compared to its 581 billion in total assets, yielding a 9.7% capital to-assets ratio after the huge loss on the peg. The capitalization of the SNB is about 2% greater than the Federal Reserve, which is $58 billion.

Additionally, the Constitution of the Swiss Confederation required the SNB to hold part of its reserves in gold at 7%. There was a Swiss goldbug referendum where about 78% of the people voted against expanding central bank gold reserves to 20% from 7%. The SNB held 39 billion in gold, marked to market on which they have suffered a huge loss since 2011.

The Federal Reserve owns zero gold because in 1933, Roosevelt took the Fed’s gold, along with everybody else’s; something overlooked by the conspiracy generators. Moreover, shares of the SNB actually trade on the Swiss stock exchange with annual shareholder meetings. The Fed’s shares are held by key banks but they do not trade on any exchange.

The Fed’s balance sheet shows as of August 2015, that the “average daily balance of the Federal Reserve SOMA holdings was approximately $4.2 trillion during the first half of 2015. Net earnings from the portfolio were approximately $54.6 billion; most of the earnings were attributable to interest income on Treasury securities and federal agency and GSE MBS.” The Fed does not mark investments to market.

There is a TIME and a PRICE where you sell and when you buy. That is the fundamental basis to everything. People who never say sell, and only buy and hold, are dangerous for they do not take reality into consideration. But so are those who simply look at the Fed and PRESUME all central banks operate the same. There are significant differences. The goldbugs hate me because I do not give people fake advice or tell them to only buy and hold no matter what. They argue I was pro-gold before and turned against gold after. Sorry, it is called being an analyst. So they try to slander me because they are wrong. They have no conscience when people lose everything. They show no remorse, just hatred toward me for calling it as it is. If you are a real analyst, you are supposed to HELP people, not bury them or trade against them. Fake analysts and politicians share the same trait – neither can say they are ever wrong. It’s always the other guy’s fault.

Telling people to buy and hold, or saying gold will go to $100,000, is just wrong and is the very propaganda the bankers want them to say to get people to buy from them at the top of every rally. That is not analysis; it is propaganda, if not fraud. No real analyst gives one-sided advice for that means that they are not doing the job of analysis. You personally attack someone (the messenger) when you cannot rebut the message.

Gold will rally on schedule. The entire world economy functions because we are all connected. Arguing manipulation because you cannot see the trend as a whole is pretty pathetic. The free markets rule for that is Adam Smith’s invisible hand. Even communism fell after 72 years (1917-1989). They killed Kondratieff for stating that the cycle will prevail, and no doubt, they would love to kill me for the same reason. Those who now want to argue manipulation and the absence of a business cycle are taking the very same position as Stalin (who had Kondratieff killed) and Keynes who argued for government manipulation of society.

Sorry – the business cycle will ALWAYS win, even against the goldbugs when they try to defy its existence as Marx, Keynes, and Stalin did. Nobody has ever defeated the business cycle. Gold will rally to new highs only when everything lines up. They will never admit that nor do they understand the global alignment because they only see everything through the eyes of metals and nothing else. An analyst does not lead people to the altar of the manipulators for slaughter.

This entry was posted in Q&A, The Global Market, Understanding Cycles and tagged Bretton Woods, Central Banks, Confidence, Euro, Federal Reserve, Gold, goldbugs, market manipulation, SNB, Swiss Francs, Valerian I, warren buffet by Martin Armstrong. Bookmark the permalink.

Posted on November 13, 2015 by Martin Armstrong

QUESTION: You say that long-term manipulations are impossible while short-term manipulations have been the focus of the bankers. Do you mean to say that not even governments can manipulate the economy perpetually? Are central banks buying US equities to manipulate the US stock market higher? It would seem that the Fed would then be accused of creating a bubble. What is going on?

Thank you.

PH

ANSWER: The age of “New Economics”, as Volcker put it, ended with the collapse of Bretton Woods and the crash of 1974. Of course, governments have tried to manipulate society and the economy. All governments operate out of their self-interest and impose punishment as their weapon. They falsify the statistics, revising them routinely, especially CPI after learning that everything is indexed to CPI. So if you reduce the CPI, you cut benefits without having to confront the people. After 1980, they removed real estate, which they considered an investment opposed to an associated cost of living, and replaced it with rent.

The entire game of societal manipulation is to maintain their power. They historically will do whatever they need to do to achieve that goal. They routinely manipulate the truth through the press. Nobody will report that the Clintons removed ALL restraints against the banks from Intrastate Banking to Glass-Steagall, or the fact that they also made student loans non-dischargeable in bankruptcy at the bankers’ request so that they could securitize them. Nobody will bring that up to Hillary because she is the favorite of the press. They attack Ben Carson and Trump all the time, but Hillary, they assume, is a coronation.

There is a HUGE difference from claiming these private persons or governments CAN manipulate everything indefinitely and realizing that no matter who they are they CANNOT perpetually manipulate society or the economy. If the former is true, then there would be no crash and burn – just a flat-line. Sorry, people may not like that statement, but there is no proof that ANYTHING has been perpetually suppressed indefinitely. Too many people say that the markets are perpetually manipulated, as if it were simply a fact, yet they tell others to buy them anyhow. They cannot offer any proof that would stand up in a court, yet anyone who disagrees is evil and dangerous.

Society is typically manipulated by government in cycles: 26 years (most common), 31 years (as proprietary trading), or the most extreme manipulation that follows the volatility models of 72 years (communism). When it comes to the collapse of the monetary system (sovereign defaults), we are looking at 10 x the 8.6, which brings us to 86 years. So from the Roosevelt devaluation of the dollar in 1934, we should see the monetary system change in 2020. There are plenty of oscillations back and forth with each interval. Nothing is ever a straight line.

The era of bank manipulations (proprietary trading) of numerous markets for SHORT-TERM plays began in 1981 and came to an end in 2013. Nobody documented market manipulations as I did. This was a huge issue in court; they threatened to throw all of my lawyers in prison unless they handed over those tapes. So, I find it ironic to claim I deny manipulations when they exaggerate everything to support their own failures.

The European banks have mostly withdrawn from manipulations. The “club” in New York is still active, but their ranks are also diminishing. This will lead to a further collapse in liquidity and that means much higher volatility.

If you cannot understand the difference, then you obviously do not have any real experience. Here is a TAPED PHONE CALL that has survived on the silver manipulation before Buffett admitted to buying $1 billion in silver between himself and a dealer. The dealer was not part of the manipulation, which was ENTIRELY short-term and not perpetual.

It was on January 28, 1998, that a class action lawsuit was filed against the commodities firms that had been buying the silver. The lawsuit maintained that the price of silver was being manipulated because the price of silver was rising as gold was going down, which was an “unprecedented” occurrence. With accusations that silver prices were being manipulated and a CFTC announcement that it was looking into the accusations, Buffet’s Berkshire issued a press release on February 3, 1998, disclosing the purchase of $1 billion. Buffet denied that he was manipulating silver, yet silver still fell to new lows and the positions were sold. The professionals stepped aside. Who were the victims? Retail small investors, as always, who were sucked in by many of the same people. Ask them what their forecast was during this one. Were they analysts who said, “DON’T BUY it’s a manipulation!” or were they cheerleaders for every rally since 2011?

Audio Player

00:00

00:00

Use Up/Down Arrow keys to increase or decrease volume.

Even after Bretton Woods, there was the 1960 crash, then again in 1963, which resulted in removing silver from coinage in 1964. It crashed again in 1966, and in 1968, a two-tiered gold market began; finally in 1971 it collapsed. The Bretton Woods system was implement in 1945 when the IMF was born. What have I stated countless times?

The longest recession is 26 years. The Long Depression of the 19th century was 26 years, starting with the panic of 1873, and concluding with the peak in interest rates in 1899. Japan’s bubble peaked in 1989, and we should see a shift start next year as 2015 was 26 years down.

Nothing can be perpetually manipulated, for the free market will always create a check and balance. There is no example of a historical trend that anyone can find. Even the Latin Monetary Union of the 19th century attempted to unify several European currencies into a single currency (like the euro) but without the surrendering of sovereignty. The currencies in 1865 were standardized, so the same weight of a gold coin was interchangeable without requiring foreign exchange fees. This lasted for two pi cycles, totaling 62 years, but there were some interruptions due to war. It was disbanded in 1927, and that was not a manipulation, just a monetary union trying to create a single European currency for trade.

Governments today are desperately trying to control everything from the press onward. This is the drive to create electronic money, which is the final straw in their desperate manipulation to sustain power to force everyone into taxation.

The real MANIPULATION is not to suppress a single market – it is to control society. That is the big game afoot. It is much bigger than simply trying to suppress gold. That accomplishes nothing. Gold is the HEDGE AGAINST GOVERNMENT, and that they know. This is why they are trying to track gold movement. We are approaching the TIME when the metals will reverse. That comes ONLY when the majority loses confidence in government. We can see the trend starting to prepare, for that is why Trump is leading. It is not about him personally, it is about throwing out career politicians, which has become a global trend.

Things go nuts when the CONFIDENCE in government declines for the majority. It has nothing to do with fiat, manipulations, bankers, or whatever. It is the collapse in confidence in government.

I have shown this chart on the collapse of the Roman Monetary System many times. The collapse took place AFTER the emperor Valerian I was captured by the Persians. Can you imagine the blow to confidence if Putin captured Obama, turned him into his footstool, and the U.S. was powerless to invade? Then you would see the collapse in the dollar just as the Romans saw the collapse in their currency. It is ALWAYS a confidence game.

As far as central banks buying U.S. equities, no, they are not manipulating the market. Interest rates are way too low and equities offer a better return. Additionally, countries like Switzerland lost a fortune on the euro peg in the area of 50 billion Swiss francs. The total population of Switzerland is just over 8 million, which means they lost 6200 francs per person or about $7,000 per person at the time.

The euro is a failure. There is nothing left in the world for big money BUT the dollar. So the lack of alternative reserves have forced central banks to buy equities. They are NOT creating money to buy equities out of thin air. Anyone who claims that is revealing their lack of international knowledge and is judging the world by the Fed, who has the power to create money as an elastic money supply. I explained back in 2011 the structural difference between the ECB and the Federal Reserve.

No one who claims all central banks have the same powers has done their homework. Some central banks buy U.S. equities, sell bonds, and shift assets WITHOUT creating money. It is just not true that all central banks can create money elastically. However, many have the powers to create money to achieve Quantitative Easing, but it is not unlimited in many cases, whereas the Federal Reserve does not require Congressional approval to buy more debt since it has the power to create elastic money from the beginning.

To carry out Quantitative Easing, central banks create money by buying securities, such as government bonds from banks with electronic cash that did not exist before. The new money swells the size of bank reserves in the economy by the quantity of assets purchased—hence the term “quantitative” easing.

The Swiss National Bank (SNB) took a huge hit on its attempt to manipulate the currency market by creating the euro-franc peg. So if they lost money, how does this stack up if they can just print money at will? It would seem strange that they could ever lose under this scenario. The SNB had a huge loss on foreign exchange positions that were denominated in euros. These euro positions were bought in a desperate attempt to prevent the appreciation of the Swiss franc against the euro for trade purposes. However, the losses were partially offset by 10 billion in price gains on stocks and bonds in its portfolio like any other investor.

Contrary to this idea that all central banks are the same, here the SNB includes 236 million in its income derived from negative interest rates paid by depositors for holding deposits there at the central bank. This Fed can only dream of this revenue source, as the Fed pays 0.25% on excess reserves amounting to welfare for bankers.

Therefore, the huge loss on the peg is the result of mark-to-market accounting on assets, rather than just showing original cost accounting as Japan did. In its published financial statements, the SNB is required by Swiss law to mark its investments to the current market price, which includes both securities (stocks and bond holdings) and gold holdings. This is strikingly different for the Federal Reserve is not mark-to-market. The SNB on March 31 posted a net worth of 56 billion chf, compared to its 581 billion in total assets, yielding a 9.7% capital to-assets ratio after the huge loss on the peg. The capitalization of the SNB is about 2% greater than the Federal Reserve, which is $58 billion.

Additionally, the Constitution of the Swiss Confederation required the SNB to hold part of its reserves in gold at 7%. There was a Swiss goldbug referendum where about 78% of the people voted against expanding central bank gold reserves to 20% from 7%. The SNB held 39 billion in gold, marked to market on which they have suffered a huge loss since 2011.

The Federal Reserve owns zero gold because in 1933, Roosevelt took the Fed’s gold, along with everybody else’s; something overlooked by the conspiracy generators. Moreover, shares of the SNB actually trade on the Swiss stock exchange with annual shareholder meetings. The Fed’s shares are held by key banks but they do not trade on any exchange.

The Fed’s balance sheet shows as of August 2015, that the “average daily balance of the Federal Reserve SOMA holdings was approximately $4.2 trillion during the first half of 2015. Net earnings from the portfolio were approximately $54.6 billion; most of the earnings were attributable to interest income on Treasury securities and federal agency and GSE MBS.” The Fed does not mark investments to market.

There is a TIME and a PRICE where you sell and when you buy. That is the fundamental basis to everything. People who never say sell, and only buy and hold, are dangerous for they do not take reality into consideration. But so are those who simply look at the Fed and PRESUME all central banks operate the same. There are significant differences. The goldbugs hate me because I do not give people fake advice or tell them to only buy and hold no matter what. They argue I was pro-gold before and turned against gold after. Sorry, it is called being an analyst. So they try to slander me because they are wrong. They have no conscience when people lose everything. They show no remorse, just hatred toward me for calling it as it is. If you are a real analyst, you are supposed to HELP people, not bury them or trade against them. Fake analysts and politicians share the same trait – neither can say they are ever wrong. It’s always the other guy’s fault.

Telling people to buy and hold, or saying gold will go to $100,000, is just wrong and is the very propaganda the bankers want them to say to get people to buy from them at the top of every rally. That is not analysis; it is propaganda, if not fraud. No real analyst gives one-sided advice for that means that they are not doing the job of analysis. You personally attack someone (the messenger) when you cannot rebut the message.

Gold will rally on schedule. The entire world economy functions because we are all connected. Arguing manipulation because you cannot see the trend as a whole is pretty pathetic. The free markets rule for that is Adam Smith’s invisible hand. Even communism fell after 72 years (1917-1989). They killed Kondratieff for stating that the cycle will prevail, and no doubt, they would love to kill me for the same reason. Those who now want to argue manipulation and the absence of a business cycle are taking the very same position as Stalin (who had Kondratieff killed) and Keynes who argued for government manipulation of society.

Sorry – the business cycle will ALWAYS win, even against the goldbugs when they try to defy its existence as Marx, Keynes, and Stalin did. Nobody has ever defeated the business cycle. Gold will rally to new highs only when everything lines up. They will never admit that nor do they understand the global alignment because they only see everything through the eyes of metals and nothing else. An analyst does not lead people to the altar of the manipulators for slaughter.

This entry was posted in Q&A, The Global Market, Understanding Cycles and tagged Bretton Woods, Central Banks, Confidence, Euro, Federal Reserve, Gold, goldbugs, market manipulation, SNB, Swiss Francs, Valerian I, warren buffet by Martin Armstrong. Bookmark the permalink.

» Al-Alaq: The monetary situation in Iraq is excellent and our reserves support the stability of the e

» utube 11/23/24 MM&C Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Pr

» utube 11/25/24 MM&C MM&C Iraq News-CBI Building Final Touches-Oil Exports-Development Road-Turkey-B

» Parliamentary movement to include the salary scale in the next session

» Parliamentary Finance Committee reveals the budget paragraphs included in the amendment

» Al-Maliki calls on the Bar Association to hold accountable members who violate professional conduct

» Politician: The security agreement with America has many aspects

» Kurdistan Planning: More than 6 million people live in the region, the oldest of them is 126 years o

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Economics saves from political drowning

» Agriculture calls for strict ban on import of "industrial fats" and warns of health risks

» Iraq is the fourth largest oil exporter to China

» Railways continue to maintain a number of its lines to ensure the smooth running of trains

» Parliament resumes its sessions tomorrow.. and these are the most important amendments in the budget

» Bitcoin Fails to Continue Rising as It Approaches $100,000

» Minister of Planning: There will be accurate figures for the population of each governorate

» Popular Mobilization Law is ready for voting

» Mechanisms for accepting people with disabilities into postgraduate studies

» Government coordination to create five thousand jobs

» Transport: Next month, a meeting with the international organization to resolve the European ban

» Census is a path to digital government

» Calls to facilitate loans and reduce interest rates for the private sector

» The launch of the third and final phase of the "population census"

» Al-Sudani: We have accomplished a step that is the most prominent in the framework of planning, deve

» Justice discusses modern mechanisms to develop investment in real estate and minors’ money

» Dubai to host Arabplast exhibition next month

» Al-Tamimi: Integrity plays a major role in establishing the foundations of laws that will uphold jus

» Reaching the most important people involved in the "theft of the century" in Diyala

» Transportation: Completion of excavation works and connection of the immersed tunnel manufacturing b

» Between internal and regional challenges... Formation of the Kurdistan government on a "slow fire" a

» Kurdistan Region Presidency: We will issue a regional order to determine the first session of parlia

» The Minister of Foreign Affairs announces the convening of the Ambassadors Conference tomorrow, Mond

» Al-Sudani: Iraq must always be at the forefront

» Al-Mashhadani: We support the Foreign Ministry in confronting any external interference that affects

» Al-Sudani chairs meeting with Oliver Wyman delegation

» Half a million beggars in Iraq.. 90% of them receive welfare salaries

» Sudanese announces preliminary results of the general population and housing census in detail

» The centenary of the Iraqi Ministry of Foreign Affairs.. A journey of challenges and achievements

» Prime Minister's Advisor Announces Assignment of Two International Companies to Study Iraqi Banking

» Agriculture: Integrated Support Project Provides 1,333 Job Opportunities

» The Media and Education Commission discuss introducing advanced curricula related to artificial inte

» Al-Mashhadani’s First Test: Discussing Israeli Threats and Avoiding Controversial Laws

» By name.. A parliamentary bloc reveals that five ministers will be questioned at the end of the legi

» The financial budget is subject to political and economic amendments in the next parliamentary sessi

» Will the government's efforts succeed in ending the electricity crisis in Iraq?

» Baghdad Airport Customs Increased to 400% After Implementing Automation

» EU: Integrated Support Project in Iraq Creates Jobs in Agriculture and Youth

» Al-Sudani attends the centenary ceremony of the establishment of the Ministry of Foreign Affairs

» Al-Mashhadani: We seek to keep foreign policy away from alignments that harm Iraq’s unity and sovere

» The Iraqi government is working to develop a competitive banking system and support the private sect

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Regional markets rise in first session of the week

» Kurdistan Region Presidency: We will issue an order to set the first session of the regional parliam

» Political differences hinder oil and gas law legislation

» Government coordination to create new job grades for graduates

» The financial budget is subject to amendments in the next parliamentary session

» Alsumaria Newsletter: Iraq reaches the final stages of the census and Parliament resumes its session

» After the elites and workers... Iranian factories "migrate" to Iraq

» Beggars in Iraq "refuse" welfare salaries.. Their profits are 10 times the salary!

» Amending the Election Law... A Means to Restore the Dilapidated Legitimacy

» Prime Minister announces population census results, Iraq reaches 45 million mark

» Find out the dollar exchange rates in the Iraqi markets

» Kurdistan Interior Ministry: General amnesty does not include those accused of killing women

» utube 11/21/24 MM&C MM&C News Reporting-Global Trade-Best Route in World-Purchase Power-Justice-Cen

» Al-Sudani discusses with the Secretary-General of the Digital Cooperation Organization enhancing dig

» President of the Republic: Partnership with the United States is essential to achieve regional stabi

» Mazhar Saleh reveals details of the 2023 budget and the 2024 budget horizon

» Absent control and rising corruption.. Sudan faces a harsh political winter

» A representative shows the laws prepared for voting during the upcoming sessions.

» Corrupt people in it.. Independent MP criticizes the performance of Al-Sudani's government

» Parliamentary Oil Committee reveals government move to end electricity crisis

» The Administrative Court postpones consideration of the lawsuit on the legitimacy of the Kirkuk gove

» MP: The ministerial reshuffle depends on consensus within the state administration

» Politicians put question marks on Al-Sudani: corruption, espionage and serving foreign interests

» The International Union of Arab Bankers honors the Chairman of the Private Banks Association: A prom

» Industry: Contracts to supply state ministries with food products

» After Shell Withdrawal, American Company Heads to Implement Al-Nibras Project in Iraq

» Revealing the fate of the Chinese deal in Iraq.. It was disrupted by this party

» The Central Bank of Iraq 77 years of challenges and reforms

» "Unprecedented numbers"... American "CNN" talks about tourism in Iraq

» After implementing automation, Baghdad Airport Customs jumps 400 percent

» Iraq participates in sustainable development activities

» Al-Sudani opens 790 model schools

» Parliamentary Culture: The Right to Information Law will satisfy all parties

» Al-Mashhadani to {Sabah}: Tomorrow we will discuss the Zionist threats

» Industry to {Sabah}: Contracts to supply state ministries with food products

» Trade cooperation between Najaf and Isfahan

» {New building} and {electronic systems} to develop forensic medicine

» A specialized center for monitoring the environmental situation in the capital

» International and parliamentary praise for the success of the "population census" process

» The European Union organizes a workshop in Basra on central administration and the wealth distributi

» The Media Authority and the Ministry of Education discuss the importance of enhancing and introducin

» Iraq's oil exports to America rose last week

» Electricity announces loss of 5,500 megawatts due to complete halt of Iranian gas supplies

» Tomorrow.. The Arab League is looking to unify its position against Israeli intentions to strike Ira

» The Central Bank moves its secret vaults to its new building.. Clarification of the truth of the cla

» Network reveals the fate of the Chinese deal.. It was disrupted by "Iraqi officials"

» From the White House to the "Leaders of Iraq"... A Message Regarding the Targeting of Baghdad