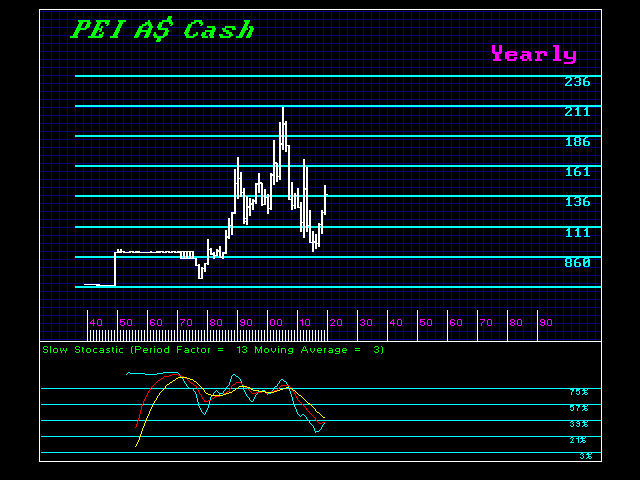

Based on the cash, we can see that the Greenback has rallied sharply against the A$ but has not elected a yearly bullish as of yet. It did exceed that level intraday, but the fact that it failed to retain those gains warns that we are not looking at new historic highs for the dollar against Australia.

Looking at the A$ in futures (opposite of cash), here is a chart of the A$ rather than the Greenback. Our Daily Bearish to watch is 7415. A closing beneath this will warn of a drop back under 72. The Weekly Bullish stands at 7819 while we have reached 7698. The Weekly Bearish lies at 7390. This is what we need to elect on a closing basis to reverse the A$ back down.

Keep in mind that the low took place the week of January 11, so April will present the extent of any reaction. March closed at 7650 and our Monthly Bearish resides at 7606. However, if we make a new high in April and retest the reversals in the 7800 zone, then this will possibly change and move lower based upon our What-If models. The Monthly Bullish stands at 7820 and the Downtrend Line stands at 8132, technically showing that we have not reversed the decline as of yet.

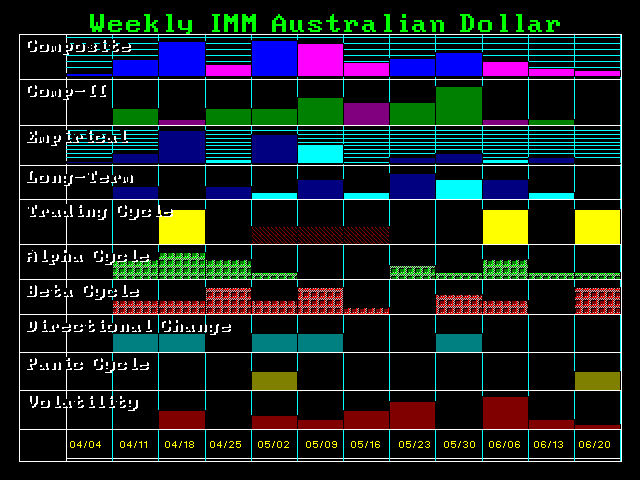

We still see the key weeks ahead as 04/18 and 05/02. It appears we should start to see rising volatility come May. We have not elected any Quarterly Bullish Reversals which begin at 8795. It does appear that we may exceed the March high during April. A daily closing back above 7627 will warn of a retest of the March high of 7698, and a break above that should produce a brief rally up to test the 7800 area.

Keep in mind that we did elect a Yearly Bearish in the Futures. To date, we are 4 years down from the highest annual closing in 2012 and 5 years down from the intraday high in 2011. It does not appear that the A$ will make a new historic low, but it will remain under pressure a while longer. It appears we are looking at a revival of the uptrend from 2017/2018. This may be fueled by the realization that the Superannuation Fund is funded when most other countries are broke.

Keep in mind that in order for the January low to hold, we need to make new highs after April and close above 7820 on a monthly closing basis. Otherwise, we are still looking at a 3-month counter-trend reaction.

https://www.armstrongeconomics.com/markets-by-sector/foreign-exchange/the-a-perspective/

» Al-Alaq: The monetary situation in Iraq is excellent and our reserves support the stability of the e

» utube 11/23/24 MM&C Reporting-Expectations are High-IMF-Flexible Exchange Rate Regime-Pr

» utube 11/25/24 MM&C MM&C Iraq News-CBI Building Final Touches-Oil Exports-Development Road-Turkey-B

» Parliamentary movement to include the salary scale in the next session

» Parliamentary Finance Committee reveals the budget paragraphs included in the amendment

» Al-Maliki calls on the Bar Association to hold accountable members who violate professional conduct

» Politician: The security agreement with America has many aspects

» Kurdistan Planning: More than 6 million people live in the region, the oldest of them is 126 years o

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Economics saves from political drowning

» Agriculture calls for strict ban on import of "industrial fats" and warns of health risks

» Iraq is the fourth largest oil exporter to China

» Railways continue to maintain a number of its lines to ensure the smooth running of trains

» Parliament resumes its sessions tomorrow.. and these are the most important amendments in the budget

» Bitcoin Fails to Continue Rising as It Approaches $100,000

» Minister of Planning: There will be accurate figures for the population of each governorate

» Popular Mobilization Law is ready for voting

» Mechanisms for accepting people with disabilities into postgraduate studies

» Government coordination to create five thousand jobs

» Transport: Next month, a meeting with the international organization to resolve the European ban

» Census is a path to digital government

» Calls to facilitate loans and reduce interest rates for the private sector

» The launch of the third and final phase of the "population census"

» Al-Sudani: We have accomplished a step that is the most prominent in the framework of planning, deve

» Justice discusses modern mechanisms to develop investment in real estate and minors’ money

» Dubai to host Arabplast exhibition next month

» Al-Tamimi: Integrity plays a major role in establishing the foundations of laws that will uphold jus

» Reaching the most important people involved in the "theft of the century" in Diyala

» Transportation: Completion of excavation works and connection of the immersed tunnel manufacturing b

» Between internal and regional challenges... Formation of the Kurdistan government on a "slow fire" a

» Kurdistan Region Presidency: We will issue a regional order to determine the first session of parlia

» The Minister of Foreign Affairs announces the convening of the Ambassadors Conference tomorrow, Mond

» Al-Sudani: Iraq must always be at the forefront

» Al-Mashhadani: We support the Foreign Ministry in confronting any external interference that affects

» Al-Sudani chairs meeting with Oliver Wyman delegation

» Half a million beggars in Iraq.. 90% of them receive welfare salaries

» Sudanese announces preliminary results of the general population and housing census in detail

» The centenary of the Iraqi Ministry of Foreign Affairs.. A journey of challenges and achievements

» Prime Minister's Advisor Announces Assignment of Two International Companies to Study Iraqi Banking

» Agriculture: Integrated Support Project Provides 1,333 Job Opportunities

» The Media and Education Commission discuss introducing advanced curricula related to artificial inte

» Al-Mashhadani’s First Test: Discussing Israeli Threats and Avoiding Controversial Laws

» By name.. A parliamentary bloc reveals that five ministers will be questioned at the end of the legi

» The financial budget is subject to political and economic amendments in the next parliamentary sessi

» Will the government's efforts succeed in ending the electricity crisis in Iraq?

» Baghdad Airport Customs Increased to 400% After Implementing Automation

» EU: Integrated Support Project in Iraq Creates Jobs in Agriculture and Youth

» Al-Sudani attends the centenary ceremony of the establishment of the Ministry of Foreign Affairs

» Al-Mashhadani: We seek to keep foreign policy away from alignments that harm Iraq’s unity and sovere

» The Iraqi government is working to develop a competitive banking system and support the private sect

» Al-Alaq: Arab consensus on the role of central bank programs in addressing challenges

» Regional markets rise in first session of the week

» Kurdistan Region Presidency: We will issue an order to set the first session of the regional parliam

» Political differences hinder oil and gas law legislation

» Government coordination to create new job grades for graduates

» The financial budget is subject to amendments in the next parliamentary session

» Alsumaria Newsletter: Iraq reaches the final stages of the census and Parliament resumes its session

» After the elites and workers... Iranian factories "migrate" to Iraq

» Beggars in Iraq "refuse" welfare salaries.. Their profits are 10 times the salary!

» Amending the Election Law... A Means to Restore the Dilapidated Legitimacy

» Prime Minister announces population census results, Iraq reaches 45 million mark

» Find out the dollar exchange rates in the Iraqi markets

» Kurdistan Interior Ministry: General amnesty does not include those accused of killing women

» utube 11/21/24 MM&C MM&C News Reporting-Global Trade-Best Route in World-Purchase Power-Justice-Cen

» Al-Sudani discusses with the Secretary-General of the Digital Cooperation Organization enhancing dig

» President of the Republic: Partnership with the United States is essential to achieve regional stabi

» Mazhar Saleh reveals details of the 2023 budget and the 2024 budget horizon

» Absent control and rising corruption.. Sudan faces a harsh political winter

» A representative shows the laws prepared for voting during the upcoming sessions.

» Corrupt people in it.. Independent MP criticizes the performance of Al-Sudani's government

» Parliamentary Oil Committee reveals government move to end electricity crisis

» The Administrative Court postpones consideration of the lawsuit on the legitimacy of the Kirkuk gove

» MP: The ministerial reshuffle depends on consensus within the state administration

» Politicians put question marks on Al-Sudani: corruption, espionage and serving foreign interests

» The International Union of Arab Bankers honors the Chairman of the Private Banks Association: A prom

» Industry: Contracts to supply state ministries with food products

» After Shell Withdrawal, American Company Heads to Implement Al-Nibras Project in Iraq

» Revealing the fate of the Chinese deal in Iraq.. It was disrupted by this party

» The Central Bank of Iraq 77 years of challenges and reforms

» "Unprecedented numbers"... American "CNN" talks about tourism in Iraq

» After implementing automation, Baghdad Airport Customs jumps 400 percent

» Iraq participates in sustainable development activities

» Al-Sudani opens 790 model schools

» Parliamentary Culture: The Right to Information Law will satisfy all parties

» Al-Mashhadani to {Sabah}: Tomorrow we will discuss the Zionist threats

» Industry to {Sabah}: Contracts to supply state ministries with food products

» Trade cooperation between Najaf and Isfahan

» {New building} and {electronic systems} to develop forensic medicine

» A specialized center for monitoring the environmental situation in the capital

» International and parliamentary praise for the success of the "population census" process

» The European Union organizes a workshop in Basra on central administration and the wealth distributi

» The Media Authority and the Ministry of Education discuss the importance of enhancing and introducin

» Iraq's oil exports to America rose last week

» Electricity announces loss of 5,500 megawatts due to complete halt of Iranian gas supplies

» Tomorrow.. The Arab League is looking to unify its position against Israeli intentions to strike Ira

» The Central Bank moves its secret vaults to its new building.. Clarification of the truth of the cla

» Network reveals the fate of the Chinese deal.. It was disrupted by "Iraqi officials"

» From the White House to the "Leaders of Iraq"... A Message Regarding the Targeting of Baghdad