Saudi Arabia Considers Paying Contractors With IOUs

Matthew Martin

Archana Narayanan

May 18, 2016 — 7:56 AM PDT Updated on May 18, 2016 — 10:54 AM PDT

The King Abdullah financial district sits on the horizon seen from a skyscraper under construction in Riyadh, Saudi Arabia, on Sunday, Jan. 10, 2016.

Photographer: Waseem Obaidi/Bloomberg

Saudi Arabia is considering using IOUs to pay outstanding bills with contractors and conserve cash, according to people briefed on the discussions.

As payment from the state, contractors would receive bond-like instruments which they could hold until maturity or sell on to banks, the people said, asking not to be identified because the information is private. Companies have received some payments in cash and the rest could come in the "I-owe-you" notes, the people said, adding that no decisions have been made on the measures.

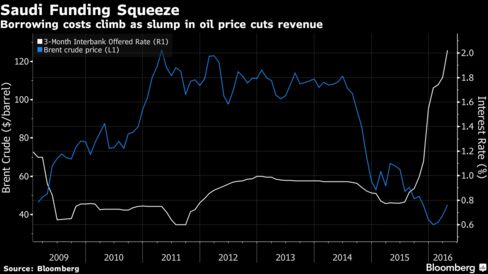

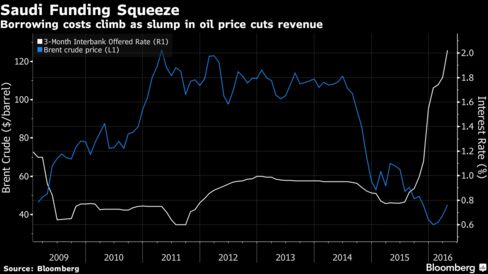

Saudi Arabia has slowed payments to contractors and suppliers, tapped foreign reserves and borrowed from local and international banks in response to the decline in crude oil, which accounts for the bulk of its revenue. The country will probably post a budget deficit of about 13.5 percent of economic output this year, according to International Monetary Fund estimates, pushing the government to borrow an estimated 120 billion riyals ($32 billion).

Deputy Crown Prince Mohammed bin Salman speaks in Riyadh, on April 25, 2016.

Source: Anadolu Agency via Getty Images

The Saudi government owes approximately $40 billion to the country’s contractors, estimated Jaap Meijer, managing director of research at Dubai-based Arqaam. Companies such as the Saudi Binladin Group are cutting thousands of jobs amid a slowdown in the construction industry, according to media reports.

“This would make sense and would help contractors get back on track,” Meijer said of the possible move. “Banks, however, would be more interested if it were a floating rate.”

Deputy Crown Prince Mohammed bin Salman told Bloomberg News in an interview in March that authorities have started paying companies back.

“Much will depend on the details of the contractor bonds,” Monica Malik, chief economist at Abu Dhabi Commercial Bank, said in an emailed response to questions. “The ability of contractors to sell these bonds to domestic banks will depend on how the pricing compares to that of government debt and if they have a floating rate.”

Saudi Arabia’s Finance Ministry declined to comment. The Saudi Arabian Monetary Agency didn’t immediately respond to a call and e-mail outside office hours.

Saudi Arabia’s economic growth is slowing as revenue from oil exports declines. Gross domestic product will likely expand 1.5 percent this year, the slowest pace since the global financial crisis, according to a Bloomberg survey of economists.

“Until there is greater clarity on this situation some negativity and increased speculation from investors and other market participants should be expected,” said Chavan Bhogaita, head of market insight and strategy at National Bank of Abu Dhabi.

http://www.bloomberg.com/news/articles/2016-05-18/saudi-arabia-said-to-consider-paying-contractors-with-ious

Matthew Martin

Archana Narayanan

May 18, 2016 — 7:56 AM PDT Updated on May 18, 2016 — 10:54 AM PDT

The King Abdullah financial district sits on the horizon seen from a skyscraper under construction in Riyadh, Saudi Arabia, on Sunday, Jan. 10, 2016.

Photographer: Waseem Obaidi/Bloomberg

Saudi Arabia is considering using IOUs to pay outstanding bills with contractors and conserve cash, according to people briefed on the discussions.

As payment from the state, contractors would receive bond-like instruments which they could hold until maturity or sell on to banks, the people said, asking not to be identified because the information is private. Companies have received some payments in cash and the rest could come in the "I-owe-you" notes, the people said, adding that no decisions have been made on the measures.

Saudi Arabia has slowed payments to contractors and suppliers, tapped foreign reserves and borrowed from local and international banks in response to the decline in crude oil, which accounts for the bulk of its revenue. The country will probably post a budget deficit of about 13.5 percent of economic output this year, according to International Monetary Fund estimates, pushing the government to borrow an estimated 120 billion riyals ($32 billion).

Deputy Crown Prince Mohammed bin Salman speaks in Riyadh, on April 25, 2016.

Source: Anadolu Agency via Getty Images

The Saudi government owes approximately $40 billion to the country’s contractors, estimated Jaap Meijer, managing director of research at Dubai-based Arqaam. Companies such as the Saudi Binladin Group are cutting thousands of jobs amid a slowdown in the construction industry, according to media reports.

“This would make sense and would help contractors get back on track,” Meijer said of the possible move. “Banks, however, would be more interested if it were a floating rate.”

Contractor Bonds

Saudi Arabia used a similar policy of repaying contractors in the 1990s, said Raza Agha, chief economist for the Middle East and Africa at VTB Capital. “This time, Saudi Arabia’s cash flow has been impacted by the fall in oil prices, but weak public financial management may also be to blame,” he said.Deputy Crown Prince Mohammed bin Salman told Bloomberg News in an interview in March that authorities have started paying companies back.

“Much will depend on the details of the contractor bonds,” Monica Malik, chief economist at Abu Dhabi Commercial Bank, said in an emailed response to questions. “The ability of contractors to sell these bonds to domestic banks will depend on how the pricing compares to that of government debt and if they have a floating rate.”

Saudi Arabia’s Finance Ministry declined to comment. The Saudi Arabian Monetary Agency didn’t immediately respond to a call and e-mail outside office hours.

Moody’s Cut

The country was among oil producers that had their ratings lowered by Moody’s Investors Service because of a collapse in oil prices, the credit-ratings company said Saturday. The long-term issuer rating on Saudi Arabia, the world’s biggest oil exporter, was cut to A1 from Aa3 as lower crude may lead to a "material deterioration" in the nation’s credit profile, Moody’s said.Saudi Arabia’s economic growth is slowing as revenue from oil exports declines. Gross domestic product will likely expand 1.5 percent this year, the slowest pace since the global financial crisis, according to a Bloomberg survey of economists.

“Until there is greater clarity on this situation some negativity and increased speculation from investors and other market participants should be expected,” said Chavan Bhogaita, head of market insight and strategy at National Bank of Abu Dhabi.

http://www.bloomberg.com/news/articles/2016-05-18/saudi-arabia-said-to-consider-paying-contractors-with-ious

» utube 5/16/24 MM&C Al-Sudani - Political Week - Progress Internationally

» Calls to include local oil and electricity sales in the general budget

» Al Rasheed Bank issues instructions to facilitate the issuance of replacement cards for bank card ho

» Internal debt rises to 79 trillion in 2024.. What is the relationship between spending and loans?

» More than one billion dollars in sales from the Central Bank of Iraq within a week

» Members of Parliament head to the Great Hall to initiate procedures for electing the president

» The House of Representatives concludes the report and discussion of the draft law on public holidays

» The House of Representatives votes to extend its legislative term for 30 days

» A Canadian company is “unable” to dismiss its director authorized to protect Baghdad Airport: Iraq i

» Economic Institution: The value of China's exports to Iraq increased by 93% in 10 years

» The Presidency of Parliament decided to devote today’s session to electing the president only

» In the presence of 183 deputies...the House of Representatives holds its session

» Al-Kadhimi hints at the possibility of postponing the session to elect the Speaker of Parliament

» The regional government announces the payment of employees' salaries via “My Account”

» The Minister of Transport reviews the details of the development road and Al-Faw Grand Port projects

» Istanbul will host expanded Turkish/Arab economic meetings at the beginning of next month

» Customs sets the date for collecting tax amounts electronically and sets a condition

» Sudanese agrees to support pilgrims with an amount of 39 billion dinars to reduce the cost of Hajj

» The Sudanese advisor clarifies the discussion of budget schedules in the extraordinary session of th

» Most of the framework and the Kurdistan Democratic Party will vote for Al-Mashhadani as Speaker of P

» A deputy considers the movement of Turkish forces inside Iraqi territory an occupation

» Directing the Ministry of Finance to spend drug law implementation budgets

» A parliamentary movement to resolve the fate of holding private wards

» A member of a legal movement calling for accelerating the amendment of Article 57

» A parliamentary effort to gain ownership of the trespassers and slum owners

» There is a consensus on deciding the presidency of Parliament today, and the balance is tilted towar

» The price of the dollar is witnessing a slight increase in Baghdad, Basra and Erbil

» Behind the scenes of electronic blackmail in Iraq... “A good hacker,” “blackmailing spouses,” and se

» The coordination framework supports Al-Sadr: We will pass the “Eid Al-Ghadir” holiday today

» The session to elect the Speaker of Parliament... intense meetings and fears of its failure due to “

» People with chronic diseases...a government statistic regarding the number of applicants for social

» The Sudanese advisor issues a clarification regarding the discussion of budget schedules in an extra

» Russia is at the top, and this is Iraq's rank... a list of countries that buy most real estate in Tü

» The opening of the first aviation, space and artificial intelligence institution in Baghdad

» Iraq digs 30 meters under the sea and completes the Al-Faw docks in 5 months...a fixed date with the

» Al-Allaq announces the success of the electronic transfer platform in combating money laundering

» Al-Saadawi directs the disbursement of 1.5 million dinars to each private transport employee who con

» Minister of Commerce from Silo Makhmour: The quantities of wheat marketed have reached two million t

» Hours after choosing Al-Halbousi's successor... Al-Mashhadani sends a message to the Iraqis

» How do we wash the “dirty Baghdad dollar”? A clearer picture of 1,000 Iraqi methods for money launde

» Transport is launching a new mechanism to pay bus tickets via phone soon

» Baghdad Summit 2025.. Iraq reunites its brothers around the table of dialogue and common interests

» Bangladesh is ahead of it... Iraq’s classification in the Arab world and internationally by the qual

» Today...the House of Representatives is scheduled for a “fateful” session

» The General Secretariat denies that the Fine platform was exposed to electronic hacking

» Transport reveals the completion rates in the Al-Faw Port and Development Road projects

» Mayor of the Capital: The Baghdad Metro project will be implemented this year by a solid investment

» A reading of the financial and monetary policies of the International Monetary Fund report - May 202

» Floating the Iraqi dinar A solution to fill the "gap" of its turbulent price against the dollar

» utube MM&C 5/14/24 Iraq Dinar - IQD Update - UN Chapter VII - $3 Billion Revenue - Trade Minister -

» Iraq announces the payment of the last installment of the International Monetary Fund loan

» The International Monetary Fund calls on Iraq to cancel the appointments and correct the course of n

» For the first time after Iraq joined the Bank’s membership: The Minister of Finance participates in

» A delegation from the Retirement Authority discusses with the World Bank reform of the retirement sy

» Istanbul.. Iraq is discussing with the World Bank reform of the country’s retirement system

» The President of the Republic stresses the importance of coordination between Iraq and Kuwait on reg

» Among them are Russia and China... Members of the Security Council support ending the mission of the

» The full statement of Iraq’s welcome of the Arab League’s decision to hold the Baghdad Summit in 202

» Parliamentary expectations of electing a new Speaker of Parliament and extending the work of the Ele

» Transparency website: Sulaymaniyah and Halabja imports amounted to about 11 billion dinars last week

» The Hajj Authority begins disbursing dollars to pilgrims via the electronic platform

» Oil announces the expansion of installing gas networks and proceeding with the import of plastic gas

» Politician: Al-Mashhadani is closest to the presidency of the House of Representatives

» Al-Ittihad: The delay in the localization of salaries has had a negative impact on the citizens of K

» A new maneuver for the region regarding the salaries of its employees...these are its details

» The Parliamentary Energy Committee determines its position on the new oil coupons

» Washington: We are communicating with officials in Baghdad, Ankara, and Erbil to resume Kurdistan oi

» In agreement with international companies, the first tourist flight was launched from Kirkuk Airport

» Al-Allaq announces the success of the electronic transfer platform in combating money laundering

» The Chinese dragon applies to Iraqi oil... Where is Iran in this equation?

» Sudanese advisor announces full repayment of IMF loans

» Al-Sudani reiterates: Iraq is heading towards expanding petrochemical projects

» The Monetary Fund: “Internal stability has improved since the new government took office in October

» Washington clarifies its position on stopping Kurdistan oil exports through Türkiye

» The Minister of Labor directs to increase electronic payment (POS) devices

» After the worsening crisis of “carrying vehicles” at the entrances to the governorates, the Minister

» The Hajj Authority begins disbursing dollars to pilgrims via the electronic platform

» Iraq reaches its “peak”... Parliamentary legal opinion opens the file of job laxity and confirms: it

» The framework is awkward between Al-Mashhadani and Al-Issawi... and he sees his salvation in the “th

» Al-Sudani directs the formation of a technical team to follow up on the procedures for implementing

» Kurdistan outlets confirm their commitment to Baghdad’s controls, but: 70% of the outlets are “outsi

» In numbers... budget tables paralyze investment allocations to governorates

» The Minister of Transport reveals the completion rates of rail and land connectivity plans for the d

» He confirmed that the memorandums of understanding signed with Washington are being implemented on t

» The Minister of Planning and the World Bank discuss supporting Iraq's policies to reduce dependence

» Bahaa Al-Araji: They killed Umm Fahd with foreign will, and Al-Mashhadani’s nomination targets Al-Su

» American official: When I see the oil industry in Kurdistan, I think of Oklahoma

» Mishaan Al-Jubouri’s leaks to the session: Al-Maliki needs Al-Mashhadani to restrain Al-Sudani and h

» Safia Al-Suhail supervises the integrity judge’s signing of a memorandum of understanding with the S

» Deputy: The budget is political, not technical, and we do not rule out obstructing it to resolve the

» New American positions towards resuming the export of Kurdistan oil... and foreign companies set a c

» With the ongoing controversy... Is Iraq responsible for smuggling weapons into Jordan?

» Not only to elect the president.. Why is tomorrow’s parliament session exceptional?

» Large spread of foreigners in optical markets

» Labor takes measures to address the foreign worker file

» Communications is looking with Amazon to create a data center to provide Internet content to Iraq

» Al-Sudani reiterates Iraq's move towards expanding petrochemical projects

» Plasschaert: We are witnessing a rising Iraq in the fields of service provision and reconstruction