POSTED ON2022-09-27 BY SOTALIRAQ

[size=52]Analysis: More than half of all Bitcoin trades are fake[/size]

[size=45]Written by: Javier Paz

[size=45] [/size]

[/size]

[size=45]Translated and Edited by: Noon Post[/size]

[size=45]A new Forbes analysis of nearly 157 cryptocurrency exchanges has found that 51 percent of reported daily bitcoin trading volume is likely fake.[/size]

[size=45]In the emerging and turbulent crypto market, where at least 10,000 cryptocurrencies are traded, Bitcoin is one of the oldest cryptocurrencies representing 40 percent of crypto assets worth $1 trillion, and is the gateway to cryptocurrency. According to the New York Digital Investment Group, about 46 million American adults own bitcoin balances, and an increasing number of institutional investors and companies are turning to emerging alternative assets.[/size]

[size=45]Can you trust the reports of a cryptocurrency exchange or an electronic brokerage about trading the most important digital currency?[/size]

[size=45]Among the most common criticisms of bitcoin is the spread of laundering trading (a form of fake exchange volume) and poor oversight across exchanges. The United States Commodity Futures Trading Commission defines money [url=https://www.cftc.gov/LearnAndProtect/EducationCenter/CFTCGlossary/glossary_wxyz.html#:~:text=Wash Trading%3A Entering into%2C or,Round Trip Trading%2C Wash Sales.]laundering trade[/url] as “the entry into or purport to enter into transactions to show that purchases and sales have taken place, without exposure to market risk or altering the position of the trader in the market.”[/size]

[size=45]Perhaps the reason why some traders engage in laundry trading is to inflate the trading volume of an asset to highlight its growing popularity. In some cases, trading bots execute these illicit trades via cryptocurrencies, increasing exchange volume, while at the same time insiders boost activity with positive feedback, driving up the price in what is known as a “pumping and dumping” system. Illicit trading is beneficial to stock exchanges because it gives the illusion that they have a larger exchange volume than they really are, which may encourage more legitimate trading.[/size]

[size=45]There is no universally accepted way of calculating the daily bitcoin exchange volume even among the most well-known research firms in the industry. At the time of writing, CoinMarketCap has had the latest 24-hour trading of Bitcoin at $32 billion, CoinGeco at about $27 billion, Nomexi at about $57 billion, and Mysari at about $5 billion.[/size]

[size=45]In addition to the challenges, there are persistent concerns about cryptocurrency exchanges confirming the news of the bankruptcy of Voyager & Celsius. In an exclusive interview with Forbes in late June, FTX CEO Sam Bankman Fred commented that there are many stock market bankruptcies that will occur. This lack of confidence in the underlying cryptocurrency markets led to the SEC's refusal to create an investment fund for spot bitcoin trading.[/size]

[size=45]Unfortunately, for those hoping to set up an investment fund to trade bitcoin spot, many of these concerns and criticisms are valid to some extent. As part of Forbes' research into the cryptocurrency ecosystem using 2021 data, we ranked the top 60 exchanges in March. We recently conducted a deeper research into the bitcoin trading markets to answer some burning questions:[/size]

[size=45]1. Where is bitcoin traded?[/size]

[size=45]2. What is the daily bitcoin trading volume?[/size]

[size=45]3. How is bitcoin traded?[/size]

[size=45]Our study evaluated 157 cryptocurrency exchanges worldwide. Here are our main findings:[/size]

[size=45]1. More than half of the reported trading volume is likely to be fake or uneconomic. Forbes estimated the industry's daily global bitcoin exchange volume at $128 billion as of June 14. This is 51 percent lower than $262 billion considering the total volume of self-reported exchanges from multiple sources.[/size]

[size=45]2. Tether, the world's largest stablecoin, continues to be the dominant currency in the crypto-trading economy, especially when it comes to its trading volume against Bitcoin. Its current market value is $68 billion, despite questions about its reserves.[/size]

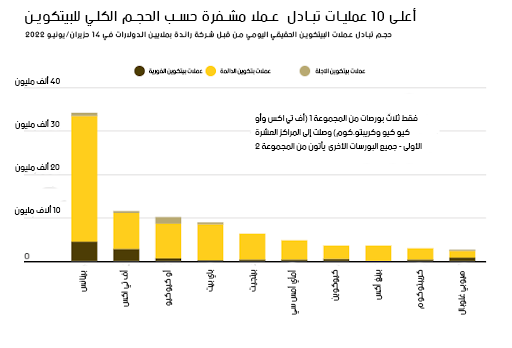

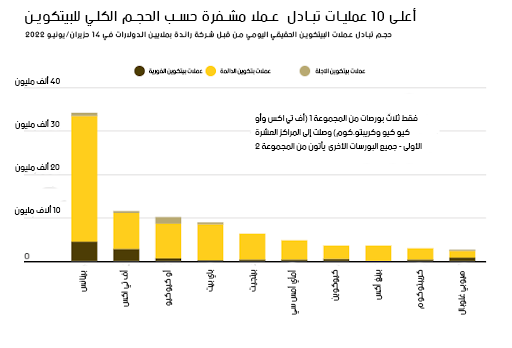

[size=45]3. In terms of the volume of Bitcoin activity in these companies, 21 crypto exchanges generate $1 billion or more in daily trading activity, while the next 33 exchanges have traded volumes between $200 million and $999 million across all types of contracts, spot contracts, and futures and permanent. Perpetual futures contracts, or perpetual swaps as they are known, are futures contracts that do not require investors to rollover their positions. Binance is the leading company with a market share of 27 percent, followed by FTX. In spot Bitcoin only, Binance, FTX and OKX share the top position. Chicago-based CME Group is the leader in bitcoin futures trading.[/size]

[size=45]4. One of the biggest challenges related to fake exchange volume are companies that promote high volume but operate with little or no regulatory oversight to make their numbers more credible, such as Binance, MEXC Global and Paybit. Altogether, the less regulated exchanges in our study represent about $89 billion in real volume (versus a claim of $217 billion).[/size]

[size=45]5. The creation of new trading assets and products such as stablecoins and perpetual futures increases the complexity for national authorities seeking to regulate cryptocurrency markets. The major US stock exchanges rarely use these instruments or contracts in any of their trading. However, offshore exchanges make great use of them as ways to artificially create US dollar liquidity on their platforms (but they cannot get US bank accounts).[/size]

[size=45]6. In the western world, especially in the United States, many believe that bitcoin is only traded against the US dollar or the euro and the pound sterling. But some of the biggest binary trading activity takes place against fiat currencies like the Japanese yen and the Korean won while major stablecoins like Binance are traded in US dollars.[/size]

[size=45]7. 573 million people visit cryptocurrency exchange sites every month.[/size]

[size=45]We hope this report builds on significant work by other digital asset researchers such as Bitwise , who in an official March 2019 report estimated that 95 percent of Bitcoin trading volume on CoinMarketCap was fake or uneconomic.[/size]

[size=48]approach[/size]

[size=45]Forbes magazine uses quantitative and qualitative analyzes to adjust the trading volume reported by exchanges. Unlike other methods that run tests on transaction data (and can also be misled), Forbes rates a company’s credibility by evaluating five data sets to analyze the company’s self-reported data, and the data comes from four crypto-media companies such as Coin Market Cap and Coin Gekko and Nomex as well as multiple exchanges and two third-party data providers.[/size]

[size=45]We apply deep discounts based on a proprietary methodology based on 10 factors such as home exchange regulator if any, volume metrics based on network exchange traffic and estimated workforce size. We also use the number and quality of cryptocurrency licenses as a tool to measure the development of each cryptocurrency exchange in matters of trade regulation and control. If the company demonstrates a commitment to transparency by conducting proofs of reserve tokens or by participating in Forbes surveys, it is eligible for a “transparency credit” that reduces any discount that might otherwise apply.[/size]

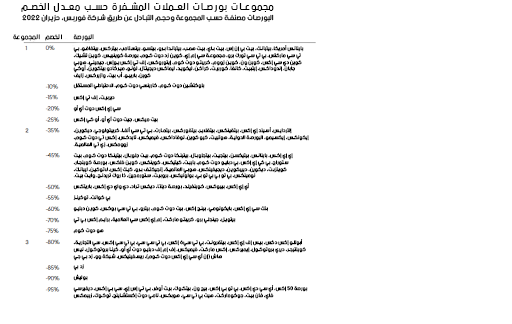

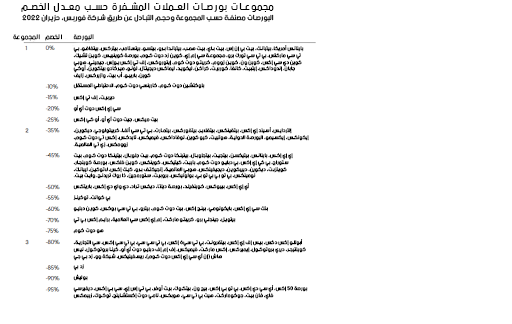

[size=45]Many of these factors were also present in Forbes' cryptocurrency exchange rankings . We have divided them into three categories:[/size]

[size=45]Group 1: 48 cryptocurrency exchanges offering discounts ranging from 0 to 25 percent and generating $39 billion in real bitcoin trading activity across all markets, derivatives and futures on June 14.[/size]

[size=45]Group 2: 73 exchanges with volume discounts of 26 to 79 percent generated $81 billion in transaction activity (versus the $158 billion claimed).[/size]

[size=45]Group 3: The remaining 36 companies were penalized at a high discount rate (80-99 percent), with $7.7 billion traded out of the $59 billion claimed.[/size]

[size=45] [/size]

[/size]

[size=45]Exchanges arranged by group and volume calculated by “Forbes” during the month of June 2022.[/size]

[size=48]Summary charts and tables[/size]

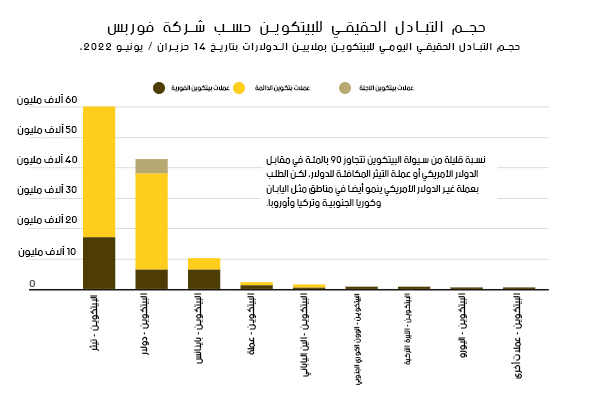

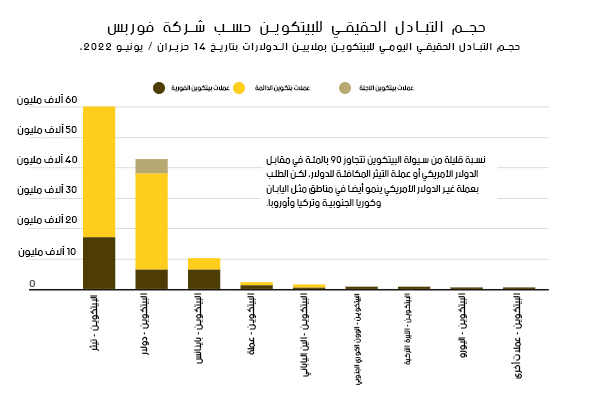

[size=45]Despite the global nature of cryptocurrencies, spot bitcoin trading activity is concentrated around a relatively few currency pairs and stablecoins. The Tether stablecoin is the largest, followed by the US dollar, while the next largest monetary assets are the Japanese yen and the South Korean won.[/size]

[size=45] [/size]

[/size]

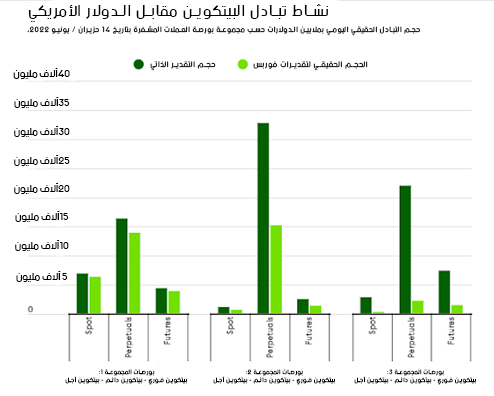

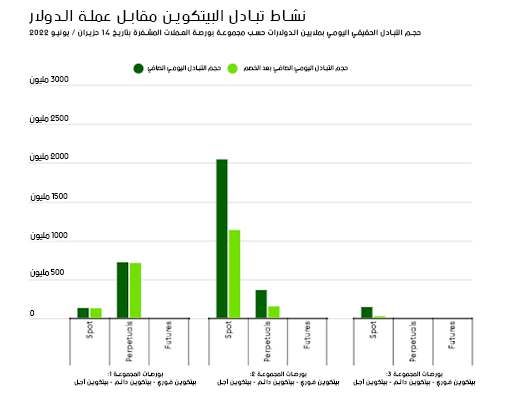

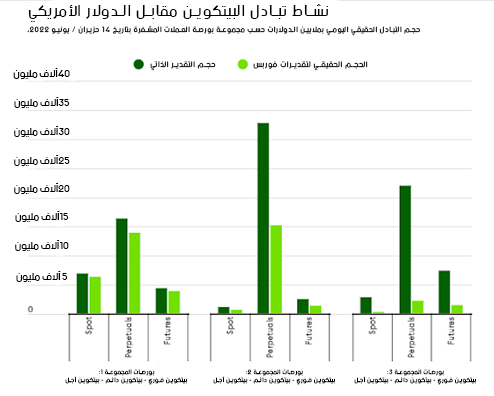

[size=48]Daily trading volume of bitcoin against the dollar[/size]

[size=45]The exchanges of the first group, many of which are located in the United States, provide $24.3 billion in daily liquidity in dollars and bitcoins, while the exchanges of the second group add $17.3 billion. The first group exchanges are important as a major source of dollars and bitcoin through spot, perpetual and futures contracts. The CME Group is the leading provider of Bitcoin futures contracts globally, with $2.1 billion worth of daily transfers of US dollars and Bitcoin traded. There are at least 27 cryptocurrency exchanges - 12 of which are in the first group - with daily dollar and bitcoin liquidity of more than $5 million.[/size]

[size=45] [/size]

[/size]

[size=45] [/size]

[/size]

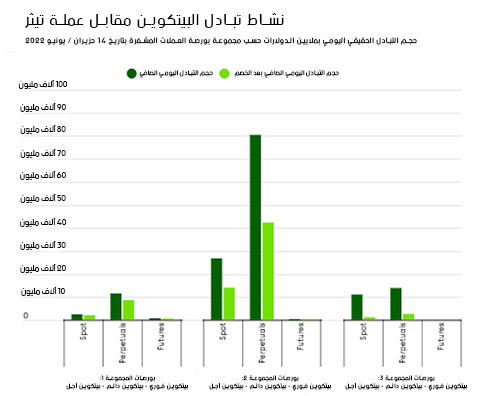

[size=45]With a daily trading volume of $71.4 billion, the activity of bitcoin and the influence of bitcoin and the dollar exceeds that of the bitcoin and the dollar by 57 percent, in addition to the 79 percent originating from cryptocurrency exchanges in the second group, and 5 percent of the third group. There are 77 exchanges - 44 of which are in the second group, and 12 in the first group, with daily Bitcoin and Tether trading volumes over $5 million. Tether dominates the spot and perpetual futures markets, and less so in the regulated futures industry, which is largely absent outside the United States.[/size]

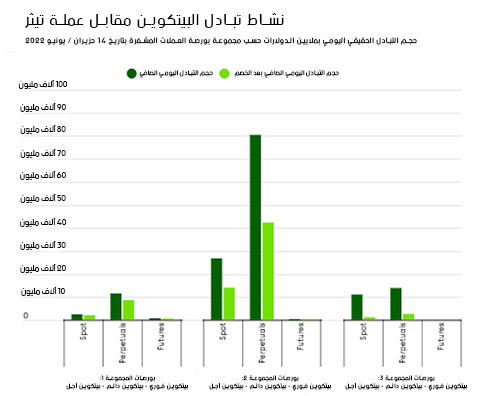

[size=48]Bitcoin and Tether trading activity[/size]

[size=45] [/size]

[/size]

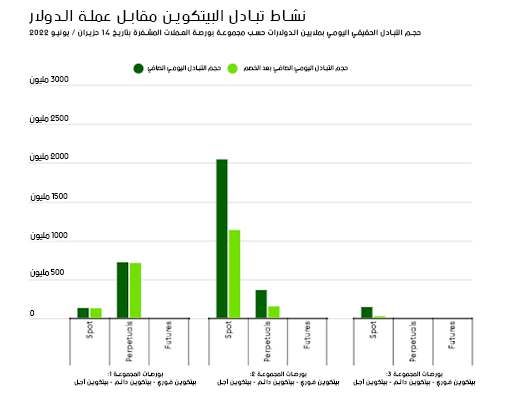

Daily real volume (in million dollars) by Cryptocurrency Exchange Group on June 14, 2022

[size=45]The US dollar is gaining confidence in the stablecoin arena. The daily liquidity of bitcoin against the dollar was $2.15 billion, with the first and second groups dividing this total by 39 percent and 60 percent, respectively. It is interesting to note that the exchanges of the second group are actively using the US dollar in the spot bitcoin market while the exchanges of the first group do so all the time. This different usage may indicate that the exchanges of the second group may be open to the idea of supporting an alternative to the dominance of Tether in the stablecoin market.[/size]

[size=45]Tether and Binance both produce more trading volume than the US dollar, but the latter now owns 26 cryptocurrency exchanges (17 of them in the second group) with a daily trading volume of $5 million or more, compared to 77 Tether exchanges and five with US Binance. And if Tether's dominance begins to wane, the US dollar could be the stablecoin most likely to pick up its crown.[/size]

[size=45] [/size]

[/size]

Disclaimer: All published articles represent the opinion of its authors only[/size]

http://www.sotaliraq.com/2022/09/27/%d8%aa%d8%ad%d9%84%d9%8a%d9%84-%d8%a3%d9%83%d8%ab%d8%b1-%d9%85%d9%86-%d9%86%d8%b5%d9%81-%d8%aa%d8%af%d8%a7%d9%88%d9%84%d8%a7%d8%aa-%d8%a7%d9%84%d8%a8%d9%8a%d8%aa%d9%83%d9%88%d9%8a%d9%86-%d9%85%d8%b2/

[size=52]Analysis: More than half of all Bitcoin trades are fake[/size]

[size=45]Written by: Javier Paz

[size=45]

[/size]

[/size][size=45]Translated and Edited by: Noon Post[/size]

[size=45]A new Forbes analysis of nearly 157 cryptocurrency exchanges has found that 51 percent of reported daily bitcoin trading volume is likely fake.[/size]

[size=45]In the emerging and turbulent crypto market, where at least 10,000 cryptocurrencies are traded, Bitcoin is one of the oldest cryptocurrencies representing 40 percent of crypto assets worth $1 trillion, and is the gateway to cryptocurrency. According to the New York Digital Investment Group, about 46 million American adults own bitcoin balances, and an increasing number of institutional investors and companies are turning to emerging alternative assets.[/size]

[size=45]Can you trust the reports of a cryptocurrency exchange or an electronic brokerage about trading the most important digital currency?[/size]

[size=45]Among the most common criticisms of bitcoin is the spread of laundering trading (a form of fake exchange volume) and poor oversight across exchanges. The United States Commodity Futures Trading Commission defines money [url=https://www.cftc.gov/LearnAndProtect/EducationCenter/CFTCGlossary/glossary_wxyz.html#:~:text=Wash Trading%3A Entering into%2C or,Round Trip Trading%2C Wash Sales.]laundering trade[/url] as “the entry into or purport to enter into transactions to show that purchases and sales have taken place, without exposure to market risk or altering the position of the trader in the market.”[/size]

[size=45]Perhaps the reason why some traders engage in laundry trading is to inflate the trading volume of an asset to highlight its growing popularity. In some cases, trading bots execute these illicit trades via cryptocurrencies, increasing exchange volume, while at the same time insiders boost activity with positive feedback, driving up the price in what is known as a “pumping and dumping” system. Illicit trading is beneficial to stock exchanges because it gives the illusion that they have a larger exchange volume than they really are, which may encourage more legitimate trading.[/size]

[size=45]There is no universally accepted way of calculating the daily bitcoin exchange volume even among the most well-known research firms in the industry. At the time of writing, CoinMarketCap has had the latest 24-hour trading of Bitcoin at $32 billion, CoinGeco at about $27 billion, Nomexi at about $57 billion, and Mysari at about $5 billion.[/size]

[size=45]In addition to the challenges, there are persistent concerns about cryptocurrency exchanges confirming the news of the bankruptcy of Voyager & Celsius. In an exclusive interview with Forbes in late June, FTX CEO Sam Bankman Fred commented that there are many stock market bankruptcies that will occur. This lack of confidence in the underlying cryptocurrency markets led to the SEC's refusal to create an investment fund for spot bitcoin trading.[/size]

[size=45]Unfortunately, for those hoping to set up an investment fund to trade bitcoin spot, many of these concerns and criticisms are valid to some extent. As part of Forbes' research into the cryptocurrency ecosystem using 2021 data, we ranked the top 60 exchanges in March. We recently conducted a deeper research into the bitcoin trading markets to answer some burning questions:[/size]

[size=45]1. Where is bitcoin traded?[/size]

[size=45]2. What is the daily bitcoin trading volume?[/size]

[size=45]3. How is bitcoin traded?[/size]

[size=45]Our study evaluated 157 cryptocurrency exchanges worldwide. Here are our main findings:[/size]

[size=45]1. More than half of the reported trading volume is likely to be fake or uneconomic. Forbes estimated the industry's daily global bitcoin exchange volume at $128 billion as of June 14. This is 51 percent lower than $262 billion considering the total volume of self-reported exchanges from multiple sources.[/size]

[size=45]2. Tether, the world's largest stablecoin, continues to be the dominant currency in the crypto-trading economy, especially when it comes to its trading volume against Bitcoin. Its current market value is $68 billion, despite questions about its reserves.[/size]

[size=45]3. In terms of the volume of Bitcoin activity in these companies, 21 crypto exchanges generate $1 billion or more in daily trading activity, while the next 33 exchanges have traded volumes between $200 million and $999 million across all types of contracts, spot contracts, and futures and permanent. Perpetual futures contracts, or perpetual swaps as they are known, are futures contracts that do not require investors to rollover their positions. Binance is the leading company with a market share of 27 percent, followed by FTX. In spot Bitcoin only, Binance, FTX and OKX share the top position. Chicago-based CME Group is the leader in bitcoin futures trading.[/size]

[size=45]4. One of the biggest challenges related to fake exchange volume are companies that promote high volume but operate with little or no regulatory oversight to make their numbers more credible, such as Binance, MEXC Global and Paybit. Altogether, the less regulated exchanges in our study represent about $89 billion in real volume (versus a claim of $217 billion).[/size]

[size=45]5. The creation of new trading assets and products such as stablecoins and perpetual futures increases the complexity for national authorities seeking to regulate cryptocurrency markets. The major US stock exchanges rarely use these instruments or contracts in any of their trading. However, offshore exchanges make great use of them as ways to artificially create US dollar liquidity on their platforms (but they cannot get US bank accounts).[/size]

[size=45]6. In the western world, especially in the United States, many believe that bitcoin is only traded against the US dollar or the euro and the pound sterling. But some of the biggest binary trading activity takes place against fiat currencies like the Japanese yen and the Korean won while major stablecoins like Binance are traded in US dollars.[/size]

[size=45]7. 573 million people visit cryptocurrency exchange sites every month.[/size]

[size=45]We hope this report builds on significant work by other digital asset researchers such as Bitwise , who in an official March 2019 report estimated that 95 percent of Bitcoin trading volume on CoinMarketCap was fake or uneconomic.[/size]

[size=48]approach[/size]

[size=45]Forbes magazine uses quantitative and qualitative analyzes to adjust the trading volume reported by exchanges. Unlike other methods that run tests on transaction data (and can also be misled), Forbes rates a company’s credibility by evaluating five data sets to analyze the company’s self-reported data, and the data comes from four crypto-media companies such as Coin Market Cap and Coin Gekko and Nomex as well as multiple exchanges and two third-party data providers.[/size]

[size=45]We apply deep discounts based on a proprietary methodology based on 10 factors such as home exchange regulator if any, volume metrics based on network exchange traffic and estimated workforce size. We also use the number and quality of cryptocurrency licenses as a tool to measure the development of each cryptocurrency exchange in matters of trade regulation and control. If the company demonstrates a commitment to transparency by conducting proofs of reserve tokens or by participating in Forbes surveys, it is eligible for a “transparency credit” that reduces any discount that might otherwise apply.[/size]

[size=45]Many of these factors were also present in Forbes' cryptocurrency exchange rankings . We have divided them into three categories:[/size]

[size=45]Group 1: 48 cryptocurrency exchanges offering discounts ranging from 0 to 25 percent and generating $39 billion in real bitcoin trading activity across all markets, derivatives and futures on June 14.[/size]

[size=45]Group 2: 73 exchanges with volume discounts of 26 to 79 percent generated $81 billion in transaction activity (versus the $158 billion claimed).[/size]

[size=45]Group 3: The remaining 36 companies were penalized at a high discount rate (80-99 percent), with $7.7 billion traded out of the $59 billion claimed.[/size]

[size=45]

[/size]

[/size][size=45]Exchanges arranged by group and volume calculated by “Forbes” during the month of June 2022.[/size]

[size=48]Summary charts and tables[/size]

[size=45]Despite the global nature of cryptocurrencies, spot bitcoin trading activity is concentrated around a relatively few currency pairs and stablecoins. The Tether stablecoin is the largest, followed by the US dollar, while the next largest monetary assets are the Japanese yen and the South Korean won.[/size]

[size=45]

[/size]

[/size][size=48]Daily trading volume of bitcoin against the dollar[/size]

[size=45]The exchanges of the first group, many of which are located in the United States, provide $24.3 billion in daily liquidity in dollars and bitcoins, while the exchanges of the second group add $17.3 billion. The first group exchanges are important as a major source of dollars and bitcoin through spot, perpetual and futures contracts. The CME Group is the leading provider of Bitcoin futures contracts globally, with $2.1 billion worth of daily transfers of US dollars and Bitcoin traded. There are at least 27 cryptocurrency exchanges - 12 of which are in the first group - with daily dollar and bitcoin liquidity of more than $5 million.[/size]

[size=45]

[/size]

[/size][size=45]

[/size]

[/size][size=45]With a daily trading volume of $71.4 billion, the activity of bitcoin and the influence of bitcoin and the dollar exceeds that of the bitcoin and the dollar by 57 percent, in addition to the 79 percent originating from cryptocurrency exchanges in the second group, and 5 percent of the third group. There are 77 exchanges - 44 of which are in the second group, and 12 in the first group, with daily Bitcoin and Tether trading volumes over $5 million. Tether dominates the spot and perpetual futures markets, and less so in the regulated futures industry, which is largely absent outside the United States.[/size]

[size=48]Bitcoin and Tether trading activity[/size]

[size=45]

[/size]

[/size]Daily real volume (in million dollars) by Cryptocurrency Exchange Group on June 14, 2022

[size=45]The US dollar is gaining confidence in the stablecoin arena. The daily liquidity of bitcoin against the dollar was $2.15 billion, with the first and second groups dividing this total by 39 percent and 60 percent, respectively. It is interesting to note that the exchanges of the second group are actively using the US dollar in the spot bitcoin market while the exchanges of the first group do so all the time. This different usage may indicate that the exchanges of the second group may be open to the idea of supporting an alternative to the dominance of Tether in the stablecoin market.[/size]

[size=45]Tether and Binance both produce more trading volume than the US dollar, but the latter now owns 26 cryptocurrency exchanges (17 of them in the second group) with a daily trading volume of $5 million or more, compared to 77 Tether exchanges and five with US Binance. And if Tether's dominance begins to wane, the US dollar could be the stablecoin most likely to pick up its crown.[/size]

[size=45]

[/size]

[/size]Disclaimer: All published articles represent the opinion of its authors only[/size]

http://www.sotaliraq.com/2022/09/27/%d8%aa%d8%ad%d9%84%d9%8a%d9%84-%d8%a3%d9%83%d8%ab%d8%b1-%d9%85%d9%86-%d9%86%d8%b5%d9%81-%d8%aa%d8%af%d8%a7%d9%88%d9%84%d8%a7%d8%aa-%d8%a7%d9%84%d8%a8%d9%8a%d8%aa%d9%83%d9%88%d9%8a%d9%86-%d9%85%d8%b2/

» utube 11/19/24 MM&C Report-Census-Global Transparency-Budget-Trade-Banking-Delete the Ze

» Barzani: The relationship with Baghdad is good and no problem can be solved by force

» Al-Mashhadani: The international system today is “fluid and in crisis” and the Middle East crisis is

» Legal Center: Iraq is the fourth Arab country in child labor and there is a need to legislate a law

» Democratic: The new regional government is a coalition and one step away from negotiations to form i

» Parliament resumes its sessions next week... and clarification of the mechanism for extending its le

» A member of the Patriotic Union of Kurdistan stresses the need to pass the Kurdistan budget law, whi

» Framework warns: Agreement with Washington will be at stake if Iraq is bombed

» Protecting Iraq is an American duty: Security agreements are not just ink on paper

» Moderate leaders...are they able to guide the path at a regional crossroads?

» Politician reveals political agreements to vote on personal status law

» US report shows the importance of the population census in Iraq: It will reshape this map

» Dollar-Dinar Exchange Rate Gap: Causes and Treatments

» The Fifth Forum for Peace and Security in the Middle East kicks off in Dohuk with the participation

» Planning for / Nina /: The census results will be announced at this time and we implemented the proj

» Former MP: Worrying circumstances accompanied the population census process in Basra

» MP Hassan Al-Asadi brings good news to a group of those covered by Article 140

» Economist: Total cost of general population census reached 951 billion dinars

» Israel's complaint against Iraq.. a prelude to an expected military action - Urgent

» Mahmoud Al-Mashhadani: What is happening today in the Middle East is a “vital area for the second Na

» The complex of forming the regional government is exacerbated by the adherence to the “old faces”

» Bitcoin hits new record

» Prime Minister's Advisor: National Development Plan 2024-2028 depends on census results

» Al-Abadi responds to Senator Lindsey Graham's statement: Incites new conflicts and wars

» War developments portend danger in Iraq.. Israeli threatening messages arrived via a regional state

» Controversy over Kurdish citizens entering Kirkuk before the population census.. What's the story?

» MP reveals date of passing general amnesty and personal status laws

» Economist: The census will lead to an increase in the share of some governorates in regional develop

» Al-Sudani directs to equip border forces with modern weapons and secure all their requirements

» Iraqi government: We are making great efforts to control the influence of factions inside Iraq

» utube 11/18/24 US President Donald Trump Statement About Iraqi Dinar New RateIraqi Dinar News

» Mazhar Saleh: Population census is the basis for achieving optimal development

» Setting the date for announcing the preliminary results of the population census

» Kurdish MP: Population census will affect all governorates financially

» Between Israeli accusations and Baghdad's position: Is Iraq heading towards an international confron

» Al-Sudani renews his directives on the necessity of completing service projects within the previousl

» Political movement calls on parliament to strike dens of corruption

» MP criticizes the Foreign Ministry's performance towards the Turkish occupation

» Parliamentary Economy Committee criticizes the government’s withdrawal of the Public-Private Partner

» Before the vote... Washington moves its agendas to prevent the approval of the personal status law

» Al-Maliki: The Zionist entity seeks to strike Iraq through its expansionist war

» MP identifies 3 black images of the American role in the Middle East

» Where is the Baghdad-Washington agreement? The Zionist entity provokes Iraq and threatens to bomb it

» Durable goods are an open option for citizens.. Planning indicates a high response to the population

» Parliamentary Legal: The regional government is trying to change the demographics of Kirkuk to regai

» Arrest warrant issued for Anbar Council member for involvement in corruption and terrorism cases

» Al-Sudani directs continued payment of wages to workers on a "daily wage" during the two days of the

» What is the relationship between the population census and the national development plan? Al-Sudani’

» Iraq's seaborne crude oil exports decline

» Will the population increase the number of representatives in Iraq?

» In cooperation with the United Nations Population Fund.. The first population census in Iraq in more

» Jordanian company completes strategic submersible pumps project in Iraq

» Rasool: The government is pursuing anyone involved in activities that threaten Iraq's security

» US military creates air bridge from Iraq to Syria

» Al-Sudani, Putin discuss Middle East issues amid unprecedented escalation of tension in the region

» Know the secrets of the Iraqi house.. Baghdad demands that Washington deter Israel

» On the second day of the curfew, Al-Sudani tours Baghdad and “meets citizens”

» Planning: Slums are counted as a fact in the population census

» Despite problems, Iraq and Turkey agree to increase trade exchange

» Iraqi regions detect drones.. and Washington informs Baghdad of "exhausting" its pressure on the ent

» Bitcoin breaks $97,000 barrier for the first time in its history

» A difference of more than two million people: Iraqi or international estimates? Who will prove the a

» In numbers.. UAE exports to Iraq grow significantly

» Problems with the lists and the minister’s travel.. Baghdad to send salaries to Kurdistan employees

» Al-Awadi: Iraq will demand a UN resolution under Chapter VII to immediately cease fire

» How will the census reflect on drawing the economic map of Iraq? An expert answers

» Al-Hakim and Al-Amiri at one table to discuss these files

» Government Advisor: Population Census is an Essential Tool for Building Effective Strategic Economic

» A legal expert explains the extent of the Security Council's response to the Zionist entity's compla

» MP: The remaining time of the government’s term may not allow for a ministerial change

» MP: Iraq has dealt a qualitative blow to international drug trafficking mafias

» During 2024.. Iraq achieves a record in fuel oil exports

» Calls to issue a parliamentary decision binding the government to cancel the agreements with Egypt a

» Central Bank of Iraq sales exceed $6 billion in a month

» Planning: Iraq will apply international standards in the general census in coordination with the Uni

» Trade: Government measures to ensure continued food flow during census days

» The Prime Minister stresses the importance of the collection sector within the system of providing e

» Iraq produces more than 6 million m3 of wastewater daily

» Prime Minister's Advisor: National development plans depend on census results

» Investment extends the grace period for Bismayah residents to enter through electronic gates

» Trade: The general population census will be a starting point for important economic transformations

» Al-Sudani confirms the government's determination to proceed with organizing tax collection in a fai

» Al-Sudani visits the headquarters of the Ministry of Planning

» The Ministry of Oil announces the resumption of work in the production line of the North Gas Company

» Christian discontent with 'alcohol ban': It opposes freedoms and causes financial losses

» Al-Mashhadani stresses the importance of the Russian role in supporting Iraq at the regional and int

» Iraqi government issues new decisions - Urgent

» Legal expert details the extent of the impact of the population census on the controversial Article

» Al-Mashhadani directs the preparation of reports on the performance of ministers, governors and head

» Minister of Labor: More than 4 million children covered by the social protection system

» Al-Sudani chairs emergency meeting of the Ministerial Council for National Security

» Directive from Al-Sudani regarding meter readers on a contract basis in electricity

» Iraq borrows $390 million from Japan to develop Basra refinery

» Iraq and the "Israel-Iran" War.. Serious Government Measures to Secure the Launching Areas of Attack

» Iraqi oil recovers and exceeds the $70 barrier

» Integrity Commission Recovers Corruption Convict From Egypt.. Who Is He?

» utube 11/18/24 MM&C IQD News Report - Contracts - Projects - Non Oil Revenue Streams - Activating

» North Gas announces resumption of production line (1000) after maintenance is completed