The Subprime Auto Loan Meltdown Is Here

By Michael Snyder, on February 24th, 2016

By Michael Snyder, on February 24th, 2016

Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this “mini-boom” was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been “repackaged” and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price.

Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this “mini-boom” was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been “repackaged” and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price.

Everything would be fine if the number of subprime borrowers not making their payments was extremely low. And that was true for a while, but now delinquency rates and default rates are rising to levels that we haven’t seen since the last recession. The following comes from Time Magazine…

It is quite foolish to try to sell expensive cars to people with bad credit. This is especially true now that the economy is slowing down significantly in many areas. But people are greedy and they are going to do what they are going to do.

The most disturbing thing to me is that many of these loans are being “repackaged” and sold off to investors as “solid investments”. The following description of what has been happening comes from Wolf Richter…

This is exactly the kind of thing that caused so much chaos with subprime mortgages.

When will we ever learn?

Meanwhile, we continue to get even more numbers that indicate that a substantial economic slowdown has already begun…

If we do not learn from history, we are doomed to repeat it. All over the world, “non-performing loans” are starting to become a major problem, and already some financial institutions are starting to get tighter with credit.

As credit conditions tighten up, this is going to cause economic activity to slow down even more. And as economic activity slows down, it is going to become even harder for ordinary people to make their debt payments.

Deflationary forces are on the rise, and most global central banks are just about out of ammunition at this point.

Everyone knew that the global debt bubble could not keep expanding much faster than the overall rate of economic growth forever.

It was only a matter of time until the bubble burst.

Now we can see signs of crisis popping up all around us, and things are only going to get worse in the months ahead…

http://theeconomiccollapseblog.com/archives/the-subprime-auto-loan-meltdown-is-here

Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this “mini-boom” was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been “repackaged” and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price.

Uh oh – here we go again. Do you remember the subprime mortgage meltdown during the last financial crisis? Well, now a similar thing is happening with auto loans. The auto industry has been doing better than many other areas of the economy in recent years, but this “mini-boom” was fueled in large part by customers with subprime credit. According to Equifax, an astounding 23.5 percent of all new auto loans were made to subprime borrowers in 2015. At this point, there is a total of somewhere around $200 billion in subprime auto loans floating around out there, and many of these loans have been “repackaged” and sold to investors. I know – all of this sounds a little too close for comfort to what happened with subprime mortgages the last time around. We never seem to learn from our mistakes, and a lot of investors are going to end up paying the price.Everything would be fine if the number of subprime borrowers not making their payments was extremely low. And that was true for a while, but now delinquency rates and default rates are rising to levels that we haven’t seen since the last recession. The following comes from Time Magazine…

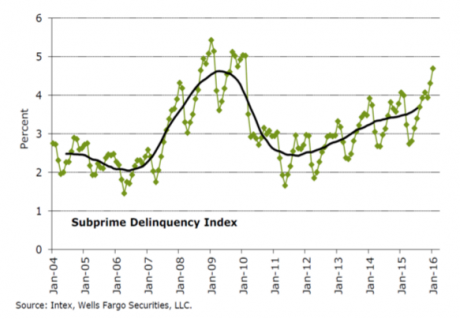

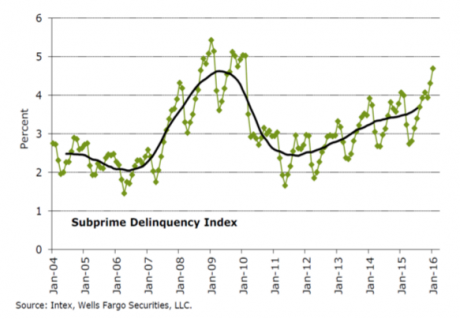

The chart below was posted by David Stockman, and it shows how the delinquency rate for subprime borrowers has hit the highest level since 2009. In fact, we are not too far away from totally smashing through the previous highs that were set during the last crisis…People, especially those with shaky credit, are having a tougher time than usual making their car payments.

According to Bloomberg, almost 5% of subprime car loans that were bundled into securities and sold to investors are delinquent, and the default rate is even higher than that. (Depending on who’s counting, delinquency is up to three or four months behind in payments; default is what happens after that). At just over 12% in January, the default rate jumped one entire percentage point in just a month. Both delinquency and default rates are now the highest they’ve been since 2010, when the ripple effects of the recession still weighed heavily on many Americans’ finances.

It is quite foolish to try to sell expensive cars to people with bad credit. This is especially true now that the economy is slowing down significantly in many areas. But people are greedy and they are going to do what they are going to do.

The most disturbing thing to me is that many of these loans are being “repackaged” and sold off to investors as “solid investments”. The following description of what has been happening comes from Wolf Richter…

It almost makes you want to tear your hair out.The business of “repackaging” these loans, including subprime and deep-subprime loans, into asset backed securities has also been booming. These ABS are structured with different tranches, so that the highest tranches – the last ones to absorb any losses – can be stamped with high credit ratings and offloaded to bond mutual funds designed for retail investors.

Deep-subprime borrowers are high-risk. Typically they have credit scores below 550. To make it worth everyone’s while, they get stuffed into loans often with interest rates above 20%. To make payments even remotely possible at these rates, terms are often stretched to 84 months. Borrowers are typically upside down in their vehicle: the negative equity of their trade-in, along with title, taxes, and license fees, and a hefty dealer profit are rolled into the loan. When the lender repossesses the vehicle, losses add up in a hurry.

This is exactly the kind of thing that caused so much chaos with subprime mortgages.

When will we ever learn?

Meanwhile, we continue to get even more numbers that indicate that a substantial economic slowdown has already begun…

Statistic after statistic is telling us that a new recession is already here. And of course some would argue that the last recession never actually ended. According to John Williams of shadowstats.com, the U.S. economy has continually been in contraction mode since 2005.We just got the clearest sign yet that something is wrong with the US economy.

Markit Economics’ monthly flash services purchasing manager’s index, a preliminary reading on the sector, fell into contraction for the first time in over two years.

The tentative February index was reported Wednesday at 49.8.

If we do not learn from history, we are doomed to repeat it. All over the world, “non-performing loans” are starting to become a major problem, and already some financial institutions are starting to get tighter with credit.

As credit conditions tighten up, this is going to cause economic activity to slow down even more. And as economic activity slows down, it is going to become even harder for ordinary people to make their debt payments.

Deflationary forces are on the rise, and most global central banks are just about out of ammunition at this point.

Everyone knew that the global debt bubble could not keep expanding much faster than the overall rate of economic growth forever.

It was only a matter of time until the bubble burst.

Now we can see signs of crisis popping up all around us, and things are only going to get worse in the months ahead…

http://theeconomiccollapseblog.com/archives/the-subprime-auto-loan-meltdown-is-here

» utube 7/25/24 MM&C Iraq Dinar Update - IQD Revaluation-Key Indicators - Deposit Insurance -Arbitra

» utube 7/23/24 MM&C Iraq Dinar-Prime Minister Advisors-Saleh-Al-Nusairi-Facts bringng facts-Reforms

» MMK&C 7/21/24 Government Advisor: Adopting auditing of foreign transfers contributes

» MM&C 7/21/24 Proposed measures to address the rise of the dollar

» Iraq ranks high in income inequality among citizens

» Within months.. Al-Imar: The amount of loans disbursed amounted to about 750 billion dinars

» Parliamentary Integrity confirms the start of opening the files of former officials

» Iraq and the German Development Bank sign an amendment to the loan agreement to finance a number of

» Regional oil...between export ban and smuggling suspicions

» Economist: Faw Port is an important step towards sustainable economic development and a major gatewa

» Parliamentary Investment "Mocks" Solution to Housing Crisis in Complexes: "Joke" and Government Must

» Multi-million dollar agreement to support Iraqi agriculture

» From Chaos to Law.. The Crowd Breathes with the First Reading of “Service and Retirement”

» Oil Minister inaugurates first phase of associated water injection project in Rumaila field

» Water Resources: The reality of desertification in Iraq is better than before

» Disappearance of 50,000 Pakistani tourists in Iraq.. Government position: We will start the investig

» Iraq reveals the value of its agricultural exports: 400 thousand tons in 6 months

» Electricity directs the rapid implementation of the solar power plant project in Khanaqin

» Worth $20 billion.. Iraq is second in trade exchanges with Iran

» (56) megawatt card.. Opening of the gas power plant in Majnoon field

» Parliamentary Committee: Amending this law will address many problems

» Iraq and the German Development Bank (KFW) sign an amendment to the loan agreement to finance a numb

» Finance discusses regulating the work of government banks with international auditing firm Ernst & Y

» The Prime Minister receives the approval of the coalition of companies that won the investment oppor

» US Ambassador: We helped Iraq with $3.6 billion in the displaced file

» In two stages.. The Minister of Oil inaugurates the associated water injection project in the Rumail

» Who manipulated the budget settings? Adding 15 trillion dinars for the benefit of the people or for

» Statement of the Iraqi Communist Workers’ Party on the “Personal Status Law Amendment” Project

» The American arm has become short.. Iraq will eradicate the “SDF” from Syria

» The idea of the “Sunni region” is maturing again.. The insistence of Western politicians collides

» Iraq takes its share of negative development and faces “electronic blackmail”

» Education in Iraq: Between the lack of schools and the delay in providing supplies

» Economist lays out solutions to get rid of the dollar’s dominance: moving towards a currency baske

» The Presidency of the Republic issues a special pardon for a bank manager accused of embezzlement

» The Ministry of Agriculture reveals the volume of its exported products in numbers

» Transport reveals its latest steps towards lifting the European ban on Iraqi Airways

» "Doors are closed" in Parliament.. Will political pressures result in the election of a new presiden

» Prime Minister's Advisor: Kirkuk government formation will be decided within 20 days

» US dollar exchange rate stability in Baghdad

» Reconstruction: New applications for Housing Fund loans will be opened when liquidity is available

» The US Federal Reserve adopts a new strategy towards Iraq.. The dollar is threatened with rising to

» First government comment on the leakage of 50 thousand Pakistanis in Iraq

» Parliamentary Integrity Committee announces keeping the session hosting the Minister of Water Resour

» Parliamentarian reveals the reason for the recent talk about the Sunni region

» Secrets of the Coordination Framework meeting with the Sunni forces.. Three proposals to resolve the

» Iraqis' spending on tourism is equivalent to the electricity budget.. What is the number of traveler

» "Two Papers of the Tashah in Parliament"... Warnings against implicating the legislative institution

» Turkish Minister reveals details about the security corridor in Iraq and the development road projec

» Does it stipulate the marriage of minors? What does the paragraph amending the Personal Status Law i

» One of the motives of the "salary scale".. Iraq is ranked 87th globally in "income inequality"

» "Vigilant Guardian"... Harmonious Supervisory Cooperation to Guarantee Citizens' Deposits in Iraqi B

» Saleh: The Central Bank's dollar reserves are solid and the GDP rate is very optimistic

» Economist accuses political parties of controlling the exchange rate on the black market

» Minister calls for establishing centers for Turkish commercial agencies inside Iraq

» 98% increase in foreign remittance sales at the Central Bank of Iraq auction

» Important meeting between Al-Sudani and the "Arabs of Kirkuk" to decide on the formation of the prov

» Housing projects in the Kurdistan Region are expensive internally and suitable externally

» Slight decline in the "green paper" in Baghdad stock exchanges

» OPEC: Iraq, Russia to compensate for surplus oil production

» Economist: The Iraqi banking sector has achieved significant growth

» Does integrity interfere with the work of institutions when they conduct investigations into suspici

» Parliamentary Finance: The Central Bank agrees to increase the capital of the Real Estate Bank to ex

» The region lags behind "electronic systems".. Transactions are still paper-based and the authenticit

» Media Authority: We are working on strategic agreements with global companies to bridge cybersecurit

» Al-Sudani stresses the importance of completing the formation of the Kirkuk government and reaching

» The region lags behind "electronic systems".. Transactions are still paper-based and the authenticit

» Iraq prepares to sign strategic agreements with global companies to bridge the digital divide in the

» Exporting (10) million liters of black oil daily.. Oil: Karbala has become an oil port that supplies

» Used as a gift and used for fraud.. The Central Bank warns against the circulation of commemorative

» Judge Faeq Zidane: International cooperation is important in the field of combating terrorism

» Al-Abbasi: Framing the relationship with Washington according to the Iraqi constitution

» Within 6 months.. The European ban on the green bird will be resolved

» Thwarting the smuggling of 21 million liters of petroleum derivatives

» Record

» Production of 24 thousand electric cars annually

» The second phase of the campaign (restricting weapons to the state) begins

» Inclusion of social protection beneficiaries in internal contracts

» The Prime Minister directs the rapid completion of Baghdad entrance projects

» Minister of Labor announces launch of health insurance service for social protection beneficiaries

» Via "Baghdad Today" .. Oil Minister announces increasing social benefits to 10 million dollars

» Joint Statement by the Iraqi and US Ministries of Defense

» Al-Sudani meets with a delegation from the American engineering consulting company KBR

» Kurdistan procrastinates to obtain the "lion's share".. Discontent over the delay in localizing empl

» Withdrawal is "Out of Reach"... Analysis of the Joint Iraqi-American Statement

» Al-Sudani stresses the importance of completing the formation of the Kirkuk government and reaching

» "Black Money" Fuels Investment Stock Exchange.. Countries That Prospered with Looted Iraqi Money

» Central Bank warns against circulation of $1 million commemorative notes

» Planning for “Al-Zawraa”: The five-year plan targets different sectors and does not include traditio

» “Unfair and deepens sectarianism”.. Why did the amendment to the Personal Status Law spark anger in

» Launching an electronic application for Iraqi retirees

» The crowd responds to Halbousi: A person convicted of forgery is not qualified to appoint himself as

» Al-Fayadh: We appreciate the Iraqi Parliament’s progress with the first reading of the service and r

» Nassif: The political process needs Al-Sadr and Al-Maliki to “rule” it

» Al-Mandlawi winks at Al-Halbousi: We reject insulting those who presented thousands of martyrs

» adhere to the rules of the Islamic religion and needs to be reformulated (tweet)

» Sarwa Abdul Wahid: The rivalry between Baghdad and Erbil is just "clacks"

» Parliamentary Finance: The Central Bank of Iraq’s measures to change the exchange rate did not achie

» Al-Sudani meets with Kirkuk Arabs to decide on the provincial government